By: Maria Williams

In an ever-changing economic landscape, financial planning for 2024 is more crucial than ever. With new market dynamics and economic uncertainties, having a robust financial plan can help individuals navigate potential challenges and seize opportunities. Designing one’s financial destiny involves making informed investment choices, setting clear, achievable goals, and staying disciplined in budgeting. This article will guide you through the essential steps to assess your current financial situation, set realistic goals, create a budget, invest wisely, plan for retirement, manage debt effectively, and protect your financial future.

Assessing Your Current Financial Situation

The first step in creating a winning financial strategy is to review your income, expenses, assets, and liabilities. Understanding these elements provides a clear picture of your financial health. According to NerdWallet, when planning to assess financial health, regularly reviewing these components helps identify areas for improvement and opportunities for growth.

The importance of understanding your financial baseline cannot be overstated. As Investopedia explains in its article on financial statements, knowing where you stand financially enables you to make informed decisions about saving, spending, and investing.

Creating a Financial Snapshot

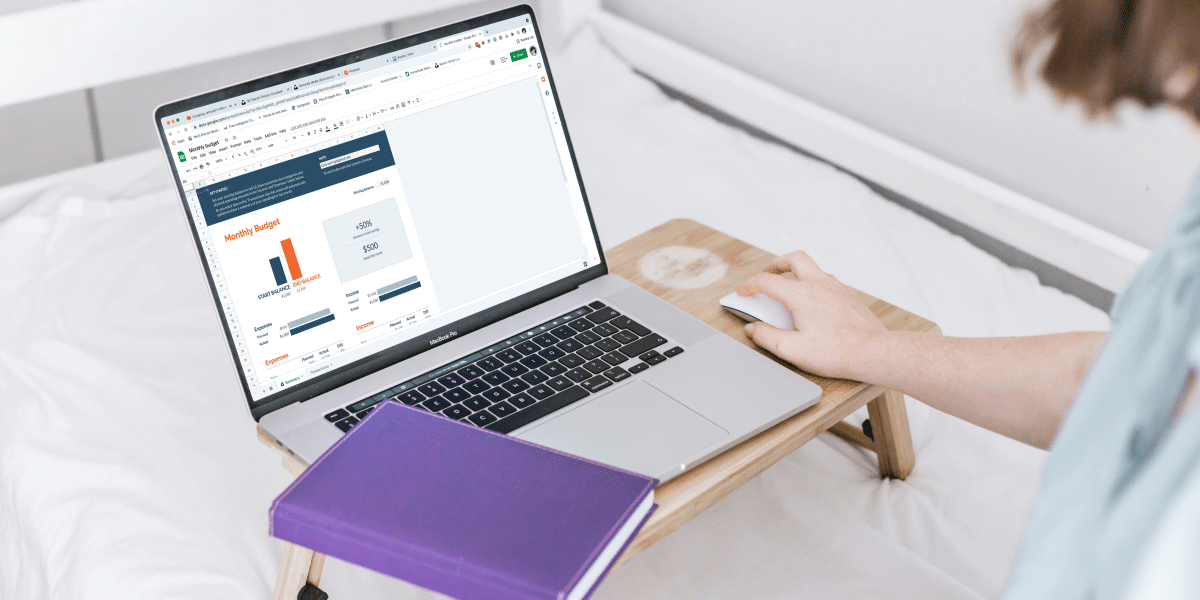

A financial snapshot is a detailed summary of your current financial situation. It includes your income sources, monthly expenses, outstanding debts, and the value of your assets. Tools like budgeting apps can help automate and simplify this process.

Identifying Financial Goals

Setting financial goals is critical for long-term success. These goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Prioritizing your goals ensures you focus on what matters most and allocate resources effectively.

Setting Clear Financial Goals

Establishing clear financial goals is crucial for creating a roadmap to financial success. It’s essential to differentiate between short-term and long-term goals. Short-term goals might include saving for a vacation or building an emergency fund, while long-term goals typically involve planning for retirement or purchasing a home. Fidelity in setting financial goals emphasizes the importance of aligning your goals with your financial situation and future aspirations.

Adopting the SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals framework can significantly enhance your financial planning. This method helps ensure that your goals are well-defined and attainable. According to SMART goals by MindTools, a clear and structured approach to goal setting can keep you focused and motivated.

Prioritizing Your Goals

Prioritizing your financial goals involves assessing which goals are most important and urgent. This helps in directing your resources and efforts efficiently to achieve the most critical objectives first.

Aligning Goals with Lifestyle Choices

Your financial goals should reflect your lifestyle and values. Ensuring that your financial plan supports your desired lifestyle can make the journey more enjoyable and sustainable.

PRO TIP: Use a vision board to visualize and stay motivated towards your financial goals. This creative process can keep your aspirations vivid and inspiring.

Budgeting for Success

A solid budget is the cornerstone of any effective financial plan. The 50/30/20 budgeting rule, popularized by Elizabeth Warren, is a simple yet powerful method to manage your finances. It suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Investopedia thoroughly explains this method.

Creating a flexible yet disciplined budget allows you to adapt to changing circumstances while maintaining financial stability. According to Dave Ramsey’s budgeting tips, the key is to track every expense and adjust your budget to stay on course.

Tracking Your Spending

Regularly tracking your spending helps you understand your financial habits and identify areas for improvement. This practice is crucial for maintaining a balanced budget and achieving financial goals.

Adjusting Your Budget as Needed

Life is unpredictable, and your budget should be flexible enough to accommodate changes. Regular reviews and adjustments ensure that your financial plan remains relevant and effective.

PRO TIP: Use budgeting apps to streamline and automate your budgeting process. These tools can provide real-time insights and help you stick to your financial plan.

Investing Wisely

Investing wisely is a fundamental aspect of building wealth and securing financial stability. One of the most critical strategies in investing is diversification. Diversifying your investments helps spread risk and can lead to more stable returns over time. According to Forbes on investment diversification, a well-diversified portfolio might include a mix of stocks, bonds, mutual funds, and real estate.

Various investment options are available, each with its own risk and return profile. Stocks offer potential for high returns but come with higher risk. Bonds are generally safer but offer lower returns. Mutual funds provide diversification within a single investment, and real estate can be a good hedge against inflation. For a comprehensive understanding, refer to Investopedia for the types of investments.

Risk Assessment and Management

Assessing and managing risk is crucial in any investment strategy. This involves understanding your risk tolerance and ensuring your portfolio aligns with it. Diversifying across different asset classes and sectors can help manage risk effectively.

Long-term vs. Short-term Investments

Balancing long-term and short-term investments is essential for a well-rounded portfolio. Long-term investments typically involve more risk but have the potential for higher returns, whereas short-term investments offer more liquidity and lower risk.

PRO TIP: Consider robo-advisors for automated, low-cost investment management. They can provide personalized advice and adjust your portfolio based on market conditions.

Planning for Retirement

Planning for retirement should begin as early as possible to take advantage of compound growth. The importance of early and consistent retirement planning cannot be overstated. As AARP explains why planning for retirement is crucial, starting early allows your investments more time to grow and helps mitigate the effects of market volatility.

There are various types of retirement accounts to consider, such as 401(k)s, IRAs, and Roth IRAs. Each offers different tax advantages and rules. For detailed information, check out the IRS on retirement plans.

Calculating Your Retirement Needs

Calculate how much money you will need to ensure a comfortable retirement based on your desired lifestyle and expected expenses. This involves estimating future costs and considering inflation.

Maximizing Employer Contributions

If your employer offers a retirement plan, such as a 401(k), contribute enough to get the full employer match. This is essentially free money and can significantly boost your retirement savings.

Managing Debt Effectively

Understanding the difference between good and bad debt is crucial for effective debt management. Good debt, such as a mortgage or student loan, can help you build assets and improve your financial situation. In contrast, bad debt, like high-interest credit card debt, can be detrimental. According to Investopedia on good debt vs bad debt, leveraging good debt can enhance your financial health, while avoiding or quickly paying off bad debt is essential.

Two popular strategies for paying off debt are the Avalanche and Snowball methods. The Avalanche method focuses on paying off debts with the highest interest rates first, saving you money on interest over time. The Snowball method, on the other hand, targets the smallest debts first, providing quick wins and motivation. For a detailed comparison, refer to The Balance on debt payoff strategies.

Consolidation and Refinancing Options

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. Refinancing can also help reduce interest rates and monthly payments, making debt more manageable. Checking your securespend card balance regularly can also help you manage your finances more effectively by keeping track of your spending and ensuring you do not overspend.

Building a Debt Repayment Plan

Creating a structured debt repayment plan involves listing all your debts, choosing a payoff strategy, and setting a timeline for becoming debt-free. Consistency and discipline are essential to successfully eliminating debt.

Protecting Your Financial Future

Protecting your financial future involves securing adequate insurance coverage for health, life, and disability. These insurances safeguard against unforeseen events that could jeopardize your financial stability. According to insurance advice from Investopedia, having the right insurance policies is a cornerstone of a solid financial plan.

Creating an emergency fund is another critical aspect of financial protection. An emergency fund provides a financial cushion to cover unexpected expenses, such as medical emergencies or job loss. For guidance on building an emergency fund, see NerdWallet on emergency funds.

Reviewing and Updating Insurance Policies

Regularly reviewing your insurance policies ensures they meet your needs as your life circumstances change. This practice helps avoid gaps in coverage and provides adequate protection.

Building an Emergency Fund

Start by setting aside a small amount regularly until you have enough to cover at least three to six months of living expenses. Keep this fund in an accessible, high-yield savings account.

PRO TIP: Review your insurance policies regularly to ensure they meet your current needs. Adjust coverage as necessary to reflect changes in your life and financial situation.

Final Thoughts

In summary, a comprehensive financial strategy is vital for achieving long-term financial stability and success. You can design your financial destiny by assessing your current financial situation, setting clear goals, budgeting wisely, investing strategically, planning for retirement, managing debt, and protecting your financial situation. Start planning today to ensure a prosperous and secure financial future in 2024 and beyond. Remember, proactive and informed financial planning is the key to financial freedom.

Disclaimer: This content is for general informational purposes only and should not be considered as financial advice. The content is not intended to be a substitute for professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

Published by: Martin De Juan