Starting a new business is an exciting journey, but it also comes with its set of challenges, especially when it comes to managing finances. Proper accounting is crucial for the success of any business, as it ensures legal compliance, aids in financial planning, and provides insights into the business’s operational performance. This article aims to guide new business owners through the basics of accounting, focusing on the role of the Federal Accounting Standards Advisory Board (FASAB), adherence to accounting principles, and leveraging business tax deductions.

The Role of the Federal Accounting Standards Advisory Board (FASAB)

In the United States, the Federal Accounting Standards Advisory Board (FASAB) plays a critical role in the accounting landscape, particularly for federal entities. Established in 1990, FASAB’s primary purpose is to develop accounting standards and principles for federal financial reporting entities. Its mission is to provide clear, concise, and useful information to the U.S. government and the public. Understanding FASAB’s guidelines is crucial for businesses that deal with federal contracts or receive federal funding, as compliance with these standards ensures transparency and accountability in financial reporting.

Adhering to Accounting Principles

For new business owners, understanding and following basic accounting principles is fundamental to maintaining accurate financial records. These principles, which are the building blocks of all accounting processes, include:

- Consistency: Applying the same accounting methods from one period to the next, ensuring comparability of financial statements over time.

- Accrual Basis: Recognizing income when earned and expenses when incurred, regardless of when cash transactions occur.

- Going Concern: Assuming that the business will continue to operate in the foreseeable future.

- Prudence: Being cautious in financial reporting, recognizing expenses and liabilities as soon as possible, but only recognizing revenue when it is assured.

By adhering to these principles, businesses can ensure their financial statements accurately reflect their financial status, which is crucial for making informed decisions and securing investment.

Utilizing Financial Metrics for Business Growth

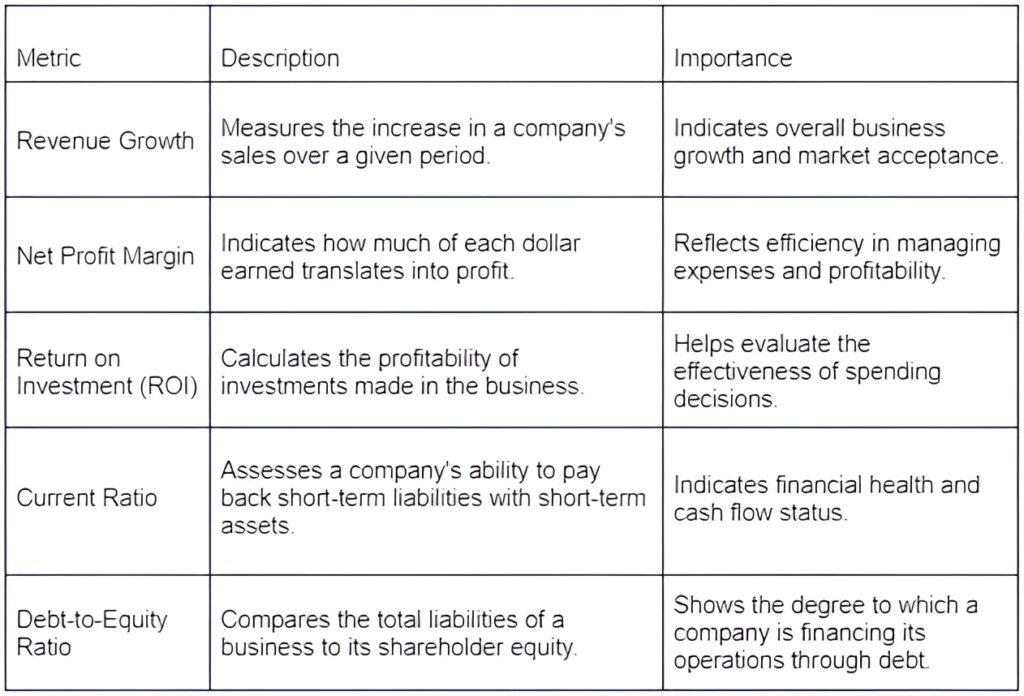

For business owners, understanding key financial metrics is essential for assessing the health and growth potential of their enterprise. These metrics provide critical data points that can help in making informed decisions about budgeting, forecasting, and business strategy. Below is a table summarizing some of the most important financial metrics that new business owners should monitor regularly:

By regularly reviewing these metrics, business owners can gain a clearer understanding of their financial performance, identify trends, and adjust their strategies accordingly. This ongoing financial analysis is crucial for maintaining a healthy business and positioning it for future success.

Importance of Professional Accounting Advice

While grasping the basics of accounting is essential for any business owner, consulting with a professional accountant can provide additional benefits. Accountants can offer expert advice tailored to the specific needs of your business, helping you navigate complex financial landscapes and avoid common pitfalls. They can assist in setting up accounting systems, ensuring compliance with the latest regulations, and planning for future financial challenges. Moreover, accountants can play a strategic role by providing insights into cost reduction, investment opportunities, and business expansion. Building a relationship with a knowledgeable accountant can not only save time and resources but also provide peace of mind knowing that your business’s financial affairs are in competent hands.

Leveraging Technology in Accounting

In today’s digital age, leveraging technology in accounting processes is another critical aspect for new business owners. Numerous accounting software solutions are available that can automate many of the tedious tasks associated with bookkeeping and financial reporting. These tools can help manage invoices, track expenses, monitor cash flows, and prepare financial statements with greater accuracy and efficiency. Moreover, modern accounting software often includes features like cloud storage, real-time data access, and integration with other business systems, such as payroll and inventory management. By adopting the right technology, business owners can streamline their accounting practices, reduce errors, and focus more on strategic business activities rather than getting bogged down in financial minutiae.

Navigating Business Tax Deductions

One of the most significant areas where accounting knowledge is essential is in understanding and maximizing business tax deductions. Effective tax planning can significantly reduce a business’s liability, freeing up capital that can be reinvested into the business. Common tax deductions for businesses include:

- Operating Expenses: All basic and necessary costs of running a business, such as rent, utilities, and payroll.

- Capital Expenses: Major purchases or investments in the business, such as equipment or property, which can be depreciated over time.

- Travel Expenses: Costs associated with business travel, which are fully deductible as long as they are ordinary and necessary.

- Home Office Deductions: If part of a home is used exclusively for business purposes, a portion of home-related expenses can be deducted.

- Interest: Interest paid on business loans is typically deductible, reducing the overall cost of the debt.

Understanding these deductions and how to properly document them can significantly impact a business’s financial health.

Conclusion

For new business owners, mastering the fundamentals of accounting is as critical as any other aspect of business management. From comprehending the role of the FASAB in setting standards to following sound accounting principles and effectively navigating tax deductions, proper accounting practices are integral to business success. By establishing robust accounting systems early, business owners can ensure greater efficiency, compliance, and profitability, setting a strong foundation for future growth.

Published By: Aize Perez