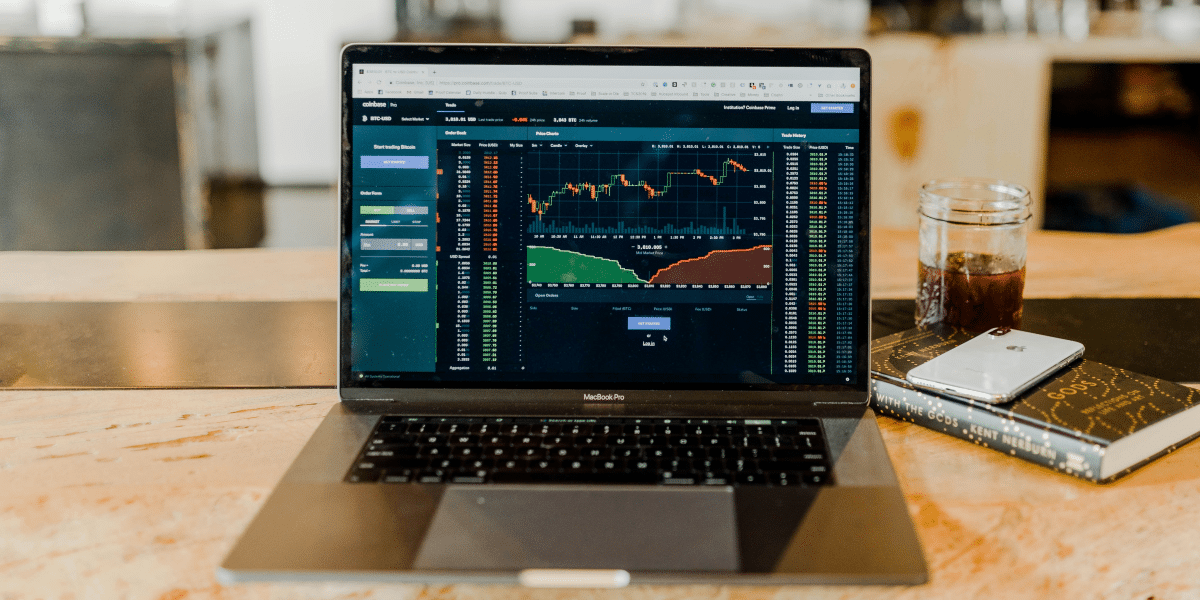

With the proliferation of investment apps in 2024, retail investors often find themselves lost in a sea of promises that every platform can cater to all their financial needs.

The rise of these apps has promised to level the playing field for retail investors—those regular folks who are often overshadowed by the colossal budgets and intricate analyses of Wall Street’s leading firms. Yet, as this year continues to unfold, many of these platforms seem to blend into a monotonous promise of “doing it all,” leaving users both overwhelmed and underinformed. However, there is a new kid on the block who’s starting to turn heads. Prospero.ai, is making an entrance with a clear mission: to empower the everyday investor by cutting through the complexities of the market with sophisticated, yet accessible technology.

Prospero.ai is positioning themselves as not just another fintech app. Their approach pivots away from the common narratives that have long dominated investment advice. Where many apps focus on superficial metrics and broad market trends, Prospero.ai digs deeper, leveraging advanced artificial intelligence to analyze market data and institutional behaviors that are often hidden from the public eye. Founded by George Kailas, whose own experiences on Wall Street revealed the skewed advantages that institutions held over individual investors, Prospero.ai is designed to democratize high-level investment strategies that were previously the preserve of hedge funds and elite financial analysts.

Kailas’s journey through the financial sector, including a stint at Bear Stearns during the precarious days of 2006, exposed him to the unfair advantages that institutions often wielded against the average taxpayer and investor. His insights, derived from real-time market data and an intimate understanding of institutional investment tactics, form the backbone of Prospero.ai’s unique offerings. The app’s core functionality revolves around proprietary market signals—ten in total—that synthesize complex data into actionable insights. These signals track various dimensions, such as net options sentiment and dark pool trading activity, to forecast market movements more accurately than traditional investment tools.

What sets Prospero.ai apart is its commitment to transparency and education. Beyond merely providing stock picks, the app educates its users on how to interpret and act on these signals. This approach has proven effective, with newsletter stock picks outperforming the S&P 500 in 2024 alone so far, following a 47% outperformance in 2023. Such figures not only highlight the app’s precision but also point the needle to its role as a tool for financial empowerment.

The app’s educational resources also contribute to its growing popularity. With a user base spread across 163 countries and both of its newsletters ranking within the top 150 finance publications on Substack, Prospero.ai is quickly becoming a cornerstone of retail investment strategy. This global reach is complemented by an active online community, where investors can engage directly with Kailas and other financial experts, enhancing their investing acumen through real-time discussions and support.

Looking forward, Kailas’s vision for Prospero.ai is ambitious. With plans for next-generation tools and paid trade alerts post-seed funding, his goal for Prospero.ai to become the world’s largest asset manager reflects not just a business objective but a broader mission to redefine the financial dreams of the average person. In a world where the wealth gap continues to widen, Prospero.ai’s strategy offers hope for retail investors, suggesting that the right tools, guided by the right philosophy, can indeed make a significant difference.

Published by: Khy Talara