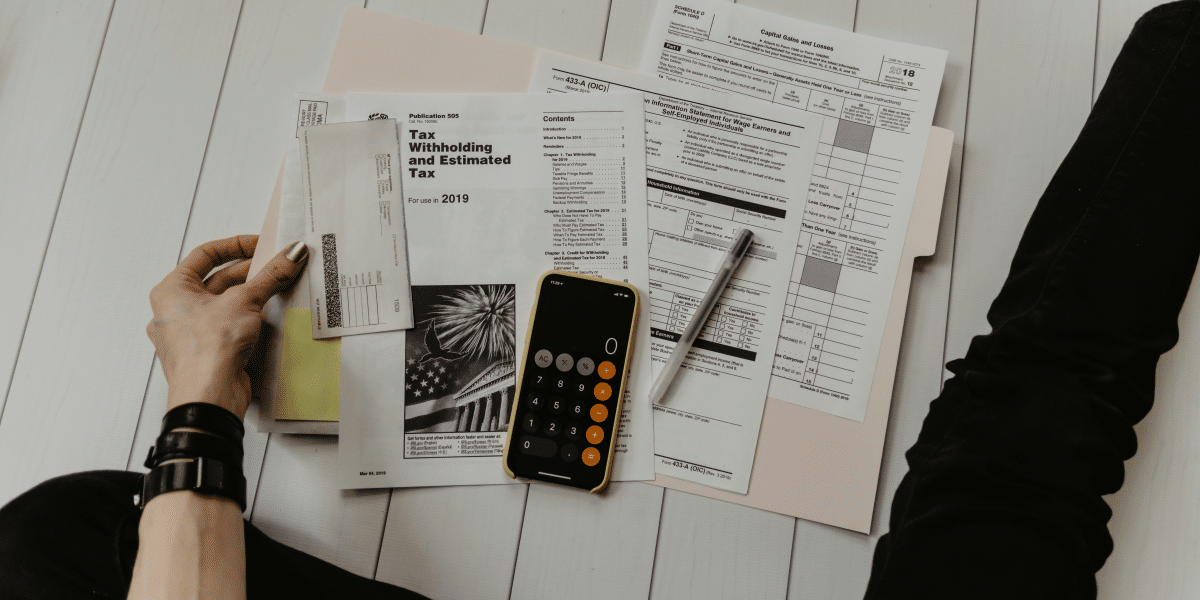

The annual task of filing taxes can often become a major inconvenience. While many individuals plan to file as soon as they receive their W-2s, procrastination often gets the better of them. Before they realize it, the deadline is near, forcing them to reshuffle their plans to accommodate tax filing, leading to unnecessary stress.

If this situation seems all too familiar, consider filing your taxes sooner rather than later. This approach will help reduce your stress and anxiety and offer a range of other benefits. Here are the benefits of filing your taxes early.

Early Filers Receive Bigger Refunds on Average

A tax refund does not equate to free cash. If you obtain a substantial refund from the IRS, it simply implies that you’ve provided an interest-free loan to the government throughout the year. Essentially, they’re just giving back your own money.

If your refund exceeds a few hundred dollars, you may need to liaise with your HR department to modify your tax withholdings on your W-4 form. The objective is to aim for a tax refund that is as minimal as possible, boosting your net income. Seeing those heftier paychecks land in your bank account will give you the sensation of receiving a pay raise.

Gain Greater Access to Your CPA

As the tax deadline approaches, the workload of your CPA intensifies. Individuals who didn’t prepare their tax documents early, those needing last-minute adjustments to their tax returns, and other late-comers will progressively add pressure on your accountant.

By filing your return earlier, you simplify scheduling appointments and calls with the exceptional CPA NYC for the required assistance. Wouldn’t it be more convenient to communicate with your CPA immediately instead of struggling to secure a slot in their busy schedule?

Have the Opportunity to Formulate a Strategy

It’s normal to delay your tax filing when expecting a bill instead of a refund. However, by proactively filling out and submitting your tax forms, you’ll have a clear idea of the exact amount due, and remember, the full payment isn’t required until Tax Day.

Moreover, giving yourself more time to gather the necessary funds minimizes the risk of overshooting your budget or depleting your emergency savings. Rather than ignoring this responsibility at the start of the year, ascertain the total amount owed, formulate a financial strategy, and take care of your tax bill as soon as possible.

Remove the Need for Filing an Extension

Set ample time for tax preparation. This allows you to review your financial records and take full advantage of any deductions that could reduce your tax liability. Determining the exact duration needed for tax preparation can be daunting. Often, individuals who delay this process run out of time, making it necessary to file for an extension.

While an extension offers a six-month breather to submit your tax return, it doesn’t extend the payment deadline for your due taxes. You must make an educated guess of your tax amount and pay it regardless.

Not settling your total tax dues by the April 15 deadline will impose interest charges and penalties. Initiating your tax preparation early is recommended to avoid the inconvenience of extensions.

Minimize Your Stress

It’s widely known that many individuals find completing their taxes unpleasant. This often results in procrastination until the eleventh hour. Such delay can undeniably lead to stress, which is frequently more intense than the task itself.

Leaving your tax return till the last moment can result in errors, some of which might be expensive. Mistakes on your return could postpone your refund, so taking your time to ensure accuracy is logical. Starting early provides you with sufficient time to compile all necessary documents for potential deductions you might qualify for, possibly leading to a larger refund. This is particularly relevant if you’re itemizing, which requires more time and paperwork than claiming the standard deduction.

Endnote

The majority of professionals recommend initiating your tax return at the earliest convenience. Your choice to submit early could hinge on how intricate your return is and if you’re due a refund. Adhere to the counsel of your financial or tax consultant to ensure that your return is precise and comprehensive.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a financial or tax professional to discuss your specific circumstances.

Published by: Martin De Juan