By Marcelo Barros, Global Markets Leader – Hacker Rangers

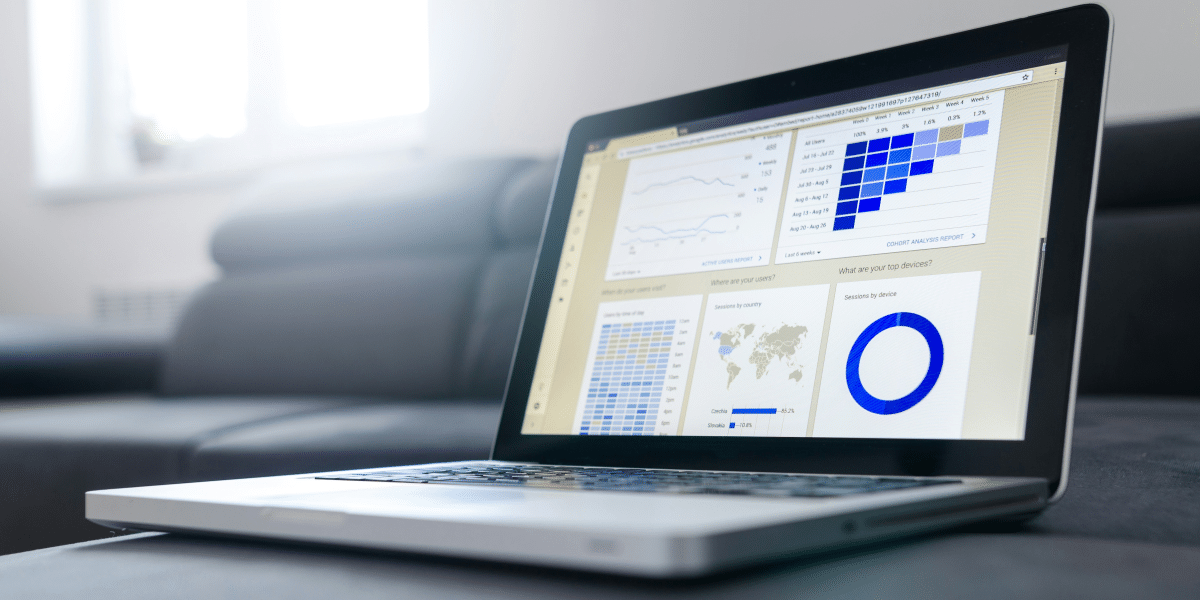

From a consumer perspective, fintech has simplified the world of finance. Today’s financial apps allow transactions to be conducted at the touch of a button. Account information is also readily available, with real-time updates accessible from any location, 24/7.

From the developer’s perspective, however, fintech is anything but simple. Making fintech effective requires balancing the needs of several stakeholders. If users, financial institutions, and regulators are dissatisfied, fintech has not accomplished its goal.

Compliance is one of the complex areas in fintech development. Because fintech blends the worlds of finance and technology, it must comply with a broad range of regulatory controls. And because of the rapid pace of technological development, compliance is an issue that must be considered and continuously addressed.

Key challenges for fintech compliance

Fintech compliance teams face the ongoing challenge of navigating an increasingly complex and rapidly evolving regulatory environment because, in many ways, regulators are still probing fintech’s implications. With each innovation comes the threat of new controls that challenge functionality and effectiveness.

Data privacy and security offer an excellent example of the compliance challenges fintech companies face. Fintech tools rely largely on data being quickly accessible. For a transaction to be approved, the processing company must have access to account balances and other personal information. However, accessibility without security puts data privacy at risk.

Regulators in some jurisdictions have issued controls that require steps to be taken to safeguard data. In the European Union, the General Data Protection Regulations (GDPR) provide guidelines for how fintech companies collect and process personal information. The GDPR — considered one of the strictest security and privacy requirements in the world — applies to companies that operate in the EU as well as foreign companies that provide services to citizens in the EU.

The California Consumer Privacy Act requires companies doing business in California to meet compliance requirements similar to those of the GDPR, with some variation regarding how key terms are defined. Together, they illustrate that staying compliant is resource-intensive for fintech companies operating across multiple jurisdictions.

The enhanced accessibility that fintech is designed to provide also brings complex compliance duties into play. Fintech tools are expected to streamline processes, taking the friction out of finances. But behind the scenes, they must ensure the transactions they support are not fraudulent, conducted with illicit funds, or done to support illicit activities.

Anti-money laundering (AML) and know-your-customer (KYC) regulations require fintech tools to integrate controls that prevent financial crimes like money laundering and terrorist financing. Complying with those regulations requires complex oversight of transactions, with due diligence failures punishable by severe civil and criminal penalties. In 2023, a Financial Times report revealed that crypto and digital payment companies were fined $5.8 billion for failing to comply with AML and other regulations.

Key steps for strengthening compliance

As developers seek to ensure compliance, they can find help in the same technology being used to support fintech platforms. Automated tools like KYC systems, blockchain technology, and real-time monitoring platforms provide solutions for maintaining compliance efficiently.

Artificial intelligence, for example, has become a key player in the fintech world. By leveraging AI to accelerate data analysis, fintech tools can streamline processes such as credit approvals and portfolio optimization.

The same AI-driven analytical skills that serve consumers can also help developers with compliance. AI delivers the power to identify suspicious patterns of financial activity in real time, allowing fintech applications to flag potential money laundering or other illicit transactions. AI-driven auditing can help fintech companies ensure compliance with a wide range of regulatory duties and accounting standards, making oversight more accurate and comprehensive.

AI also provides the potential to bolster compliance by automating repetitive and time-consuming tasks. While some compliance measures still require a human touch, particularly when addressing human risk, companies can free up human resources to improve compliance oversight by delegating routine tasks to AI.

Cybersecurity awareness training is an essential and often overlooked step to strengthening fintech compliance. Effective data protection is a core requirement of many compliance measures imposed on fintech tools. To optimize data protection measures, fintech companies must ensure their employees are equipped to play their part.

To be effective, cybersecurity training must educate employees on recognizing and responding to cyber threats. It should address critical topics like phishing, social engineering, and malware attacks to ensure companies meet compliance requirements and foster a vigilant, informed workforce.

Recent statistics show that the vast majority of data breaches, which are a key compliance concern for fintech companies, involve human error. Some studies have found that 88 percent of data breaches occur because employees fail to maintain security standards, highlighting how essential cybersecurity training is for reducing those common and costly mistakes.

The future of fintech depends on development that prioritizes both consumer satisfaction and regulatory compliance. By pursuing innovations that increase efficiency while strengthening security, fintech developers can ensure their products remain trustworthy, effective, and profitable.

– Marcelo Barros, Global Markets Leader of Hacker Rangers, is an IT veteran who has played an instrumental role in delivering cutting-edge cybersecurity solutions and services to clients around the world. His passion for cybersecurity led him to join the team at Hacker Rangers, a leading gamification company that makes cyber awareness fun and engaging for organizations worldwide.

Published by Mark V.