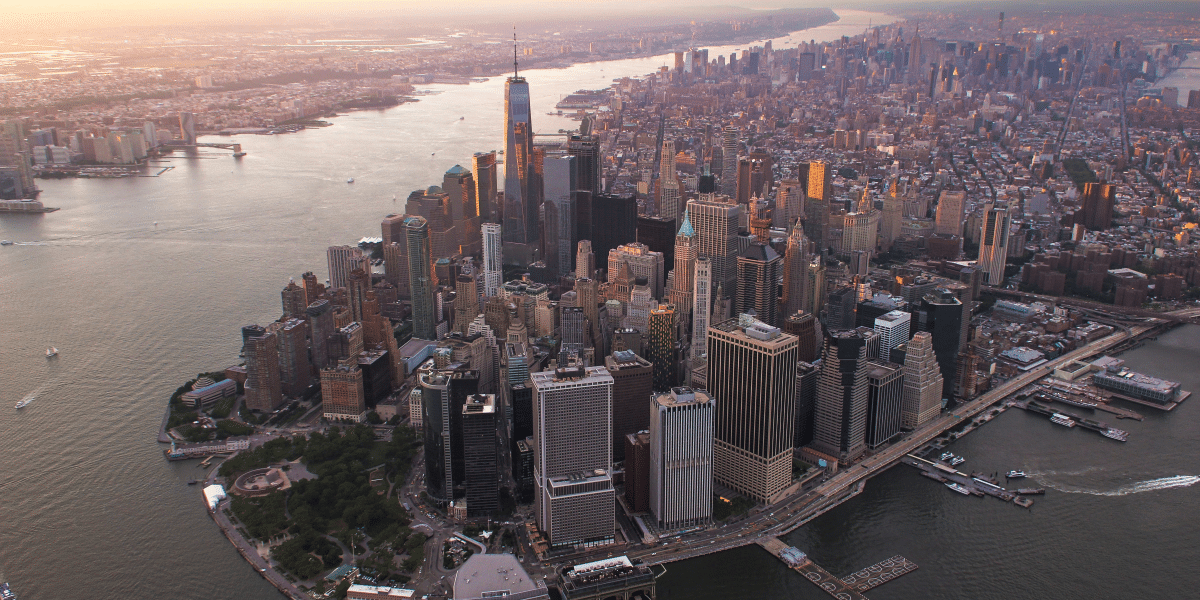

The vibrant economic fabric of New York City, known for its resilience, has faced unprecedented challenges in the aftermath of the COVID-19 pandemic. Small and midsize companies, the backbone of the city’s diverse economy, have encountered significant obstacles in rebounding from the crisis. The pandemic has tested their financial durability and forced a reevaluation of traditional business models and strategies.

As the city emerges from the shadow of COVID-19, these businesses confront a new landscape marked by changed consumer behaviors, disrupted supply chains, and a shift toward digitalization. The need for robust financial health and adaptability has never been more critical. Navigating this complex terrain requires a keen understanding of the challenges and opportunities ahead.

Enter Dean Barta, the founder and CEO of Barta Business Group, who brings over three decades of experience guiding businesses through turbulent times. With a deep understanding of the intricacies of New York’s economic environment, Barta offers invaluable insights into overcoming the financial and bookkeeping hurdles that small and midsize companies face. His expertise sheds light on practical strategies for achieving sustainable growth and stability in a post-pandemic world.

The Challenges Ahead

New York’s small and midsize businesses navigate a complex financial terrain characterized by high operational costs, stringent regulations, and intense competition. Key issues include:

- Cash Flow Management: Many businesses need help with the timely management of receivables and payables, leading to cash flow constraints.

- Regulatory Compliance: Navigating New York’s dense regulatory landscape requires resources many small businesses need help allocating.

- Financial Planning and Analysis: Limited access to financial expertise hampers businesses’ ability to plan for growth and manage risks effectively.

- Adoption of Technology: While technology can streamline bookkeeping processes, many small businesses need to adopt modern financial tools.

- Separation of Personal and Business Finances: A common pitfall for entrepreneurs, this issue complicates tax preparation and financial analysis.

Dean Barta’s Solutions

Drawing on over 30 years of experience, Dean Barta suggests a multifaceted approach to tackle these challenges:

- Embrace Technology: Barta emphasizes integrating bookkeeping software like QuickBooks and Xero. These tools automate invoicing, payroll, and expense tracking, enabling real-time financial decision-making.

- Understand Financial Statements: A clear grasp of balance sheets, income, and cash flow statements is vital. Regular engagement with these documents helps identify trends, manage expenses, and spot growth opportunities.

- Efficient Receivables Management: Barta advises implementing systems for prompt invoicing and follow-ups on overdue payments. Offering multiple payment options can encourage timely remittances.

- Regular Financial Review: Scheduling consistent financial reviews can prevent minor issues from escalating. It allows businesses to adjust budgets and respond proactively to market changes.

- Maintain Clear Financial Boundaries: Separating personal and business finances is crucial for accurate bookkeeping and tax preparation. It also protects personal assets from business liabilities.

- Plan for Major Expenses: Proactively budgeting for significant expenses ensures they don’t disrupt cash flow or operational stability. This foresight is essential for long-term financial health.

- Seek Professional Guidance: Barta underscores the value of expert advice for complex financial management. Professional consultants can tailor strategies to a business’s unique needs, fostering growth and stability.

Implementing Solutions in the New York Context

Implementing Barta’s strategies requires a tailored approach to the New York business environment. Companies should leverage local networks for technology adoption, engage with financial consultants familiar with state regulations, and utilize city-specific resources for small business support.

New York’s small and midsize companies face daunting financial challenges, but with strategic planning and expert guidance, they can navigate these waters successfully. Dean Barta’s insights from Barta Business Group provide a financial resilience and growth roadmap. New York businesses can build a robust economic foundation in a competitive market by embracing technology, understanding financial fundamentals, and seeking professional advice.

About Barta Business Group

Barta Business Group, led by Dean Barta, specializes in offering comprehensive financial solutions to small and midsize businesses. Focusing on long-term stability and growth, the group provides services ranging from bookkeeping and accounting to strategic planning and risk management. For more information, visit www.bartabusinessgroup.com.

Published by: Nelly Chavez