By: SEO Mavens

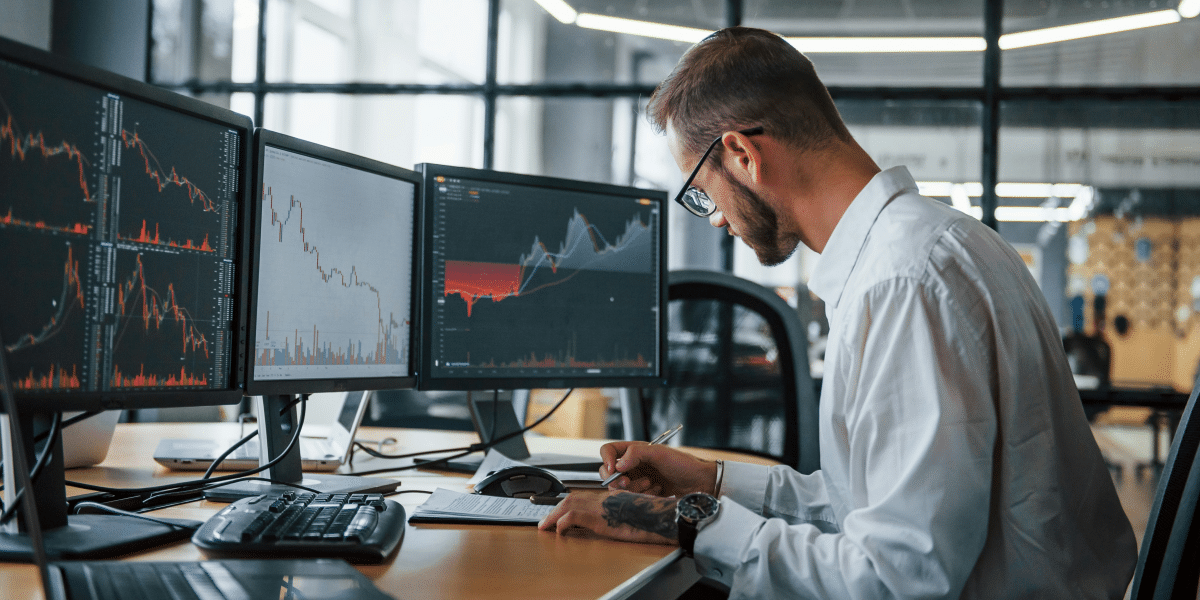

The Rise of AI in Retail Trading

The foreign exchange market is witnessing a significant transformation as artificial intelligence and machine learning tools become increasingly accessible to retail traders. This shift is democratizing sophisticated trading strategies that were once exclusive to institutional investors, creating unprecedented opportunities for individual market participants.

Industry experts note a significant increase in retail forex traders adopting AI-powered analysis tools in the first quarter of 2024, marking a substantial change in how individual traders approach currency markets. These tools range from pattern recognition algorithms to sentiment analysis systems that process vast amounts of market data in real-time, enabling traders to make more informed decisions with greater efficiency.

Changing Demographics in Forex Trading

“The integration of AI in forex trading isn’t just about automation – it’s about enhancing human decision-making capabilities,” explains Mark Chen, a veteran forex analyst. “We’re seeing retail traders achieve more consistent results by combining traditional technical analysis with AI-driven insights.”

The trend has particularly gained momentum among younger traders, with millennials and Gen Z traders showing the highest adoption rates of AI trading tools. These demographics are naturally more comfortable with technology-driven solutions and are leading the charge in embracing innovative trading approaches. Recent surveys indicate that a significant majority of new forex traders in younger age groups incorporate some form of AI-assisted analysis in their trading strategies.

The Critical Role of Education

However, trading experts emphasize the importance of proper education and understanding of both traditional forex fundamentals and modern tools. “While AI tools can provide valuable insights, successful trading still requires a solid foundation in market knowledge,” notes Sarah Rodriguez, a market strategist. “The key is to view AI as an enhancement to traditional trading skills, not a replacement.”

For traders looking to navigate this evolving landscape, educational resources have become increasingly vital. Platforms like PipPenguin.net have emerged as valuable resources, offering comprehensive broker reviews and educational content covering various aspects of trading, from forex fundamentals to advanced AI trading strategies. These platforms play a crucial role in bridging the knowledge gap between conventional trading methods and emerging technologies.

Risk Management in the AI Era

One critical aspect often overlooked in the AI trading revolution is the evolution of risk management practices. Modern AI tools now incorporate sophisticated risk assessment capabilities, helping traders:

- Monitor position sizes automatically

- Implement dynamic stop-loss orders

- Analyze market volatility patterns

- Assess correlation risks across multiple currency pairs

- Generate real-time risk reports

Regulatory Landscape and Future Outlook

The rise of AI in forex trading has also led to increased scrutiny from regulatory bodies worldwide. Financial authorities are developing new frameworks to help ensure these tools are used responsibly and transparently, protecting retail traders while fostering innovation. Several major regulatory bodies have already introduced guidelines specifically addressing AI-powered trading systems.

Industry analysts predict this trend will continue to accelerate throughout 2024, with new AI-powered tools becoming even more sophisticated and accessible. However, they caution that success in forex trading still relies on a combination of technical knowledge, market understanding, and disciplined risk management.

The Path Forward

As the forex market continues to evolve, the key to success lies in staying informed and educated about both traditional trading principles and emerging technologies. Traders who can effectively combine these elements while maintaining sound risk management practices are positioned to succeed in today’s dynamic forex market.

The integration of AI has also led to the emergence of new trading communities and knowledge-sharing platforms. These communities facilitate:

- Exchange of trading strategies and insights

- Discussion of AI tool implementations

- Sharing of premier practices and risk management techniques

- Collaborative learning environments

For retail traders looking to stay competitive in this rapidly changing environment, continuous education and adaptation to new tools and strategies remain essential. The future of forex trading appears to be a hybrid approach, where human insight and AI capabilities work in tandem to create more effective trading strategies.

Market experts predict that by the end of 2024, AI-assisted trading will become the norm rather than the exception in retail forex trading, making it imperative for traders to adapt to this new paradigm while maintaining a strong foundation in traditional trading principles.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Forex trading involves substantial risk, and individuals should not trade or invest unless they fully understand the risks involved. Past performance does not guarantee future results. Readers are encouraged to consult with financial professionals before making any trading decisions, as the use of AI-powered tools does not ensure profitability or eliminate trading risks.

Published by: Nelly Chavez