After considering these important criteria for purchasing a Software as a Service (SaaS) business can be an exciting investment opportunity. As demand for SaaS solutions surges forward, more entrepreneurs are turning their eye toward existing SaaS companies for sale on various online and offline platforms that sell businesses as an entryway into this field. Before diving headfirst into such ventures all key considerations for buying one must be addressed effectively before embarking on this venture.

Market Research

Before purchasing a SaaS business, conducting exhaustive market research is of critical importance. This includes investigating various facets of its landscape to gain in-depth knowledge. For example, studying market trends provides useful insight into where the industry is heading so prospective buyers can anticipate both opportunities and threats more accurately.

Second, studying competitor landscapes provides valuable lessons about what works and doesn’t within a market, giving buyers insight into strategic acquisition decisions. Thirdly, understanding target audience demographics enables organizations to tailor products and services specifically to address consumer needs effectively; by synthesizing this insight buyers can make educated judgments regarding the viability and potential profitability of any potential businesses they may consider buying into.

Understanding market dynamics requires more than surface analysis; rather it demands an in-depth knowledge of consumer preferences, industry regulations, and technological breakthroughs.

Due Diligence

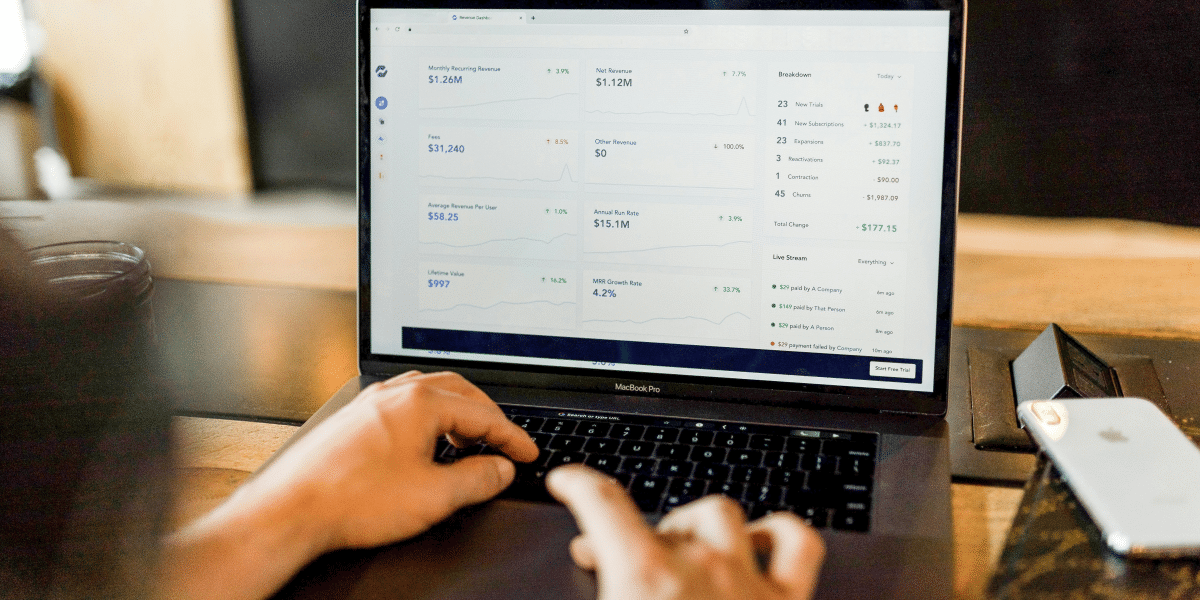

Due diligence is an integral component of assessing the financial health and potential risks of SaaS companies, including reviewing various aspects such as revenues, expenses, and profitability to gauge viability and potential. Initially, financial records provide insight into a company’s revenue, expenses, and profitability that help buyers assess its stability and performance.

Second, customer acquisition costs provide valuable insights into the effectiveness of marketing and sales strategies employed by a business; buyers can assess its ability to attract and retain customers by doing this analysis. Thirdly, revenue projections enable buyers to forecast future earnings as well as evaluate its growth potential over the longer-term horizon.

Due diligence should not only involve crunching numbers; it must also include understanding the market environment in which a company operates – including industry trends, competitive dynamics, and regulatory landscapes that could present potential threats and opportunities.

Business Model Evaluation

To properly evaluate a SaaS business model, it’s vitally important to examine its core pillars to ascertain its efficacy and growth potential. Understanding pricing strategies, revenue streams, customer retention mechanisms, and subscription-based models provides critical insight. Firstly, pricing analyses reveal how subscription models, freemium tiers, or usage-based pricing structures monetize offerings provided by businesses.

Decoding these strategies and their relationship to market demand allows buyers to assess a company’s revenue generation capabilities and competitive positioning, while customer retention mechanisms offer insights into its ability to foster long-term relationships with its user base, providing increased predictability and sustainability of revenue generation.

Technical Infrastructure Assessment

A SaaS business’s technical infrastructure serves as its backbone, supporting daily operations and providing seamless service delivery to its customer base. Therefore, conducting an in-depth assessment of this aspect is imperative in gauging their readiness for future expansion or growth.

This assessment covers numerous areas, from reviewing software architecture to ensure its scalability, reliability, and flexibility to meet changing business needs to evaluating security measures implemented within the technical infrastructure to prevent cybersecurity threats or data breaches affecting both company operations as well as customers.

Additionally, studying source code and tech stack provides insights into its robustness, maintainability, and compliance with industry regulations and standards. Assessing company adherence to practices in software development as well as commitments towards ongoing maintenance updates is crucial in maintaining long-term technical infrastructures and their resilience.

Legal and Compliance Considerations

Acquiring a SaaS business necessitates careful navigation through numerous legal and compliance issues that could affect its success or viability, especially intellectual property rights (i.e. trademarks, copyrights, and patents related to its product and underlying technology). One key area is intellectual property protection rights: these may cover trademarks, copyrights, and patents associated with your SaaS product and related technology.

Reviewing your company’s intellectual property portfolio is essential in assessing ownership rights, validity, and potential infringement risks as well as in assessing the adequacy of intellectual property protection measures such as licensing agreements or non-disclosure agreements to safeguard proprietary assets and boost competitive edge within its market environment.

Summary

Acquiring a SaaS business can be rewarding and should be approached carefully and research-intensive. By understanding the market, conducting due diligence on business models and infrastructure evaluation, and reviewing legal compliance issues as well as legal/compliance aspects you will make more informed decisions when purchasing SaaS companies for sale. Explore opportunities with care before approaching acquisition processes professionally to achieve optimal success in making sound business investments.

Published by: Martin De Juan