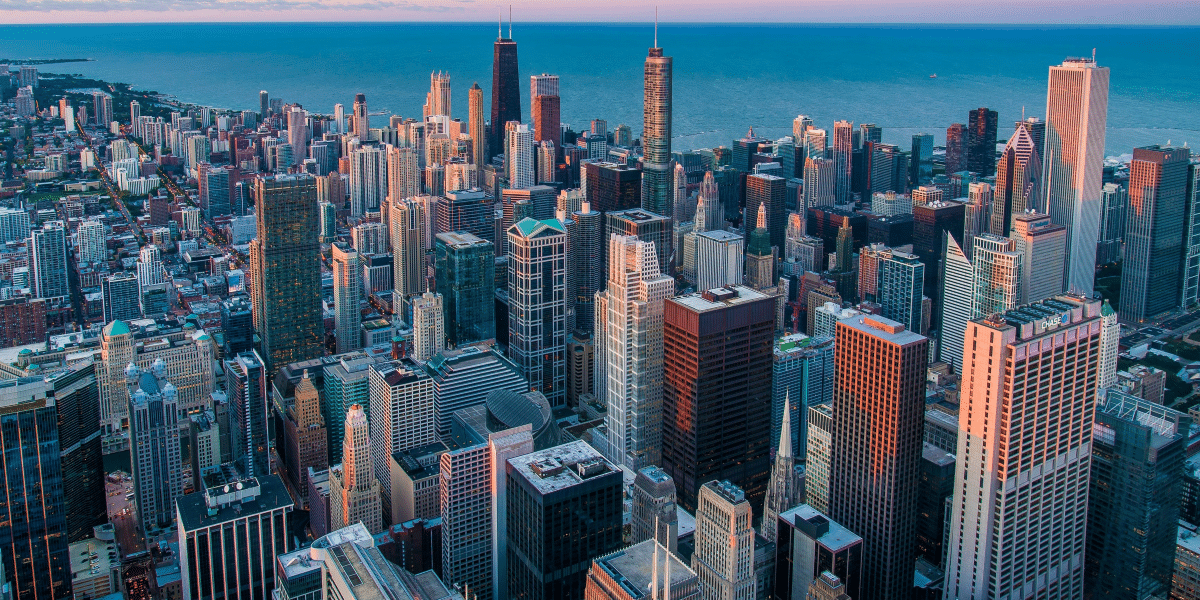

Have you ever wondered what it takes to start a small business in a state as dynamic and resource-rich as Illinois? With over 1.2 million small businesses accounting for nearly 45% of the state’s workforce, Illinois offers a strong platform for entrepreneurs.

From accessible funding programs to dedicated resources like Small Business Development Centers, the state works to support new ventures. Let’s take a look at some of the essential steps, tools, and opportunities you need to kickstart your journey, ensuring your business has the chance to thrive in one of the more entrepreneur-friendly states in the U.S.

Your Step-by-Step Guide to Getting Started

Starting a small business in Illinois involves several crucial steps to ensure compliance with state regulations and to set a solid foundation for success. First, it’s essential to develop a comprehensive business plan that outlines your objectives, target market, competitive analysis, and financial projections. This plan will serve as a roadmap and is often required when seeking financing.

Before finalizing your business plan, it’s wise to test your business idea to avoid unnecessary risks. A structured approach and testing the viability of your business idea can help you assess demand, understand customer pain points, and refine your offerings before investing time and resources.

Next, choose a suitable business structure, such as a sole proprietorship, partnership, limited liability company (LLC), or corporation, as this decision affects your liability, taxation, and regulatory obligations. For instance, forming an LLC in Illinois requires filing Articles of Organization with the Secretary of State and designating a registered agent with a physical Illinois address.

After establishing your business structure, register your business name with the appropriate authorities. If operating under a name different from your legal name, you must file an Assumed Business Name with the county clerk’s office. Obtain necessary licenses and permits, which may vary based on your industry and location.

Taxes Made Simple for Small Business Owners

Navigating the tax landscape is a critical aspect of operating a small business in Illinois. The state imposes a corporate income tax rate of 7% on C corporations, calculated based on net income.

In addition to the corporate income tax, Illinois levies a personal property replacement tax of 2.5% on the net income of corporations and 1.5% on partnerships, trusts, and S corporations. Understanding these obligations is essential to ensure compliance and to plan effectively for your business’s financial health.

For businesses engaged in the sale of tangible goods or certain services, collecting and remitting sales tax is mandatory. The statewide base sales tax rate is 6.25%, but local jurisdictions may impose additional taxes, leading to varying total rates depending on your location. Keeping up to date with the specific rates in your area is crucial, as they can change and directly impact your pricing strategies and tax liabilities.

If you have employees, you’re required to handle state income tax withholding from their wages and pay state unemployment insurance taxes. Accurate payroll processing and timely tax payments are key to maintaining compliance and avoiding penalties.

Understanding your obligations regarding health insurance is also important. While Illinois doesn’t mandate that small businesses provide it, offering comprehensive small business health insurance can help with employee retention and may offer tax advantages.

Tapping Into Illinois’s Business Resources

Illinois offers a strong network of resources to support small business owners and aspiring entrepreneurs. The Illinois Small Business Development Centers, located throughout the state, provide confidential business guidance, training, and other resources for startups and existing small businesses. These centers assist with business plan development, market analysis, financial planning, and navigating regulatory requirements.

For comprehensive regulatory and permitting information, the First Stop Business Information Center serves as a single statewide resource. Business specialists offer professional guidance, helping entrepreneurs identify and navigate regulatory requirements and connect with state and local resources. Services include a toll-free helpline and email support.

Utilizing these resources can significantly enhance your business’s potential for success. By leveraging the expertise and support offered by Illinois SBDCs and the First Stop Business Information Center, you can confidently navigate the complexities of starting and growing a business in Illinois.

Smart Marketing Ideas to Help Your Business Stand Out

Implementing effective marketing strategies is essential for small businesses in Illinois to differentiate themselves in a competitive market. A pivotal approach is optimizing for local search engine optimization (SEO). Notably, 46% of all Google searches are seeking local information, highlighting the importance of local SEO for businesses aiming to attract nearby

By ensuring your business appears prominently in local search results, you can increase visibility and drive foot traffic. Key steps include claiming and optimizing your Google My Business profile, maintaining consistent name, address, and phone number (NAP) information across online directories, and encouraging customer reviews to enhance credibility.

Engaging with the local community through events and partnerships is another impactful strategy. Collaborating with non-competing local businesses can expand your reach and build a supportive network. Participating in community events or sponsoring local initiatives not only boosts brand visibility but also fosters trust and loyalty among local consumers.

Leveraging social media platforms is crucial for connecting with your target audience. Creating engaging content that resonates with local interests can enhance brand awareness and customer engagement. Collaborating with local influencers can also amplify your reach.

What’s Next for Small Businesses in Illinois?

Illinois’s small business landscape is experiencing significant growth, with a notable increase in entrepreneurial activity. In 2023, the state recorded 174,667 new business applications, marking a 12% rise compared to December 2022. This surge reflects a strong entrepreneurial spirit and positions Illinois as a promising environment for small business development.

The state is actively supporting this growth through substantial financial initiatives. The State Small Business Credit Initiative has allocated up to $354.6 million to Illinois, aiming to improve access to capital for small businesses, particularly those owned by socially and economically disadvantaged individuals.

Conclusion

What’s stopping you from turning your entrepreneurial dream into a reality in Illinois? With dedicated state support, a thriving small business ecosystem, and access to invaluable resources like the Illinois Small Business Development Centers and Advantage Illinois programs, the opportunities are vast.

By following the steps outlined (developing a solid plan, navigating taxes, securing funding, and leveraging smart marketing strategies), you can position your business for growth and stability. The future for small businesses in Illinois is bright, and with the right preparation, your venture can find success in this dynamic environment.

Published by Joshua F.