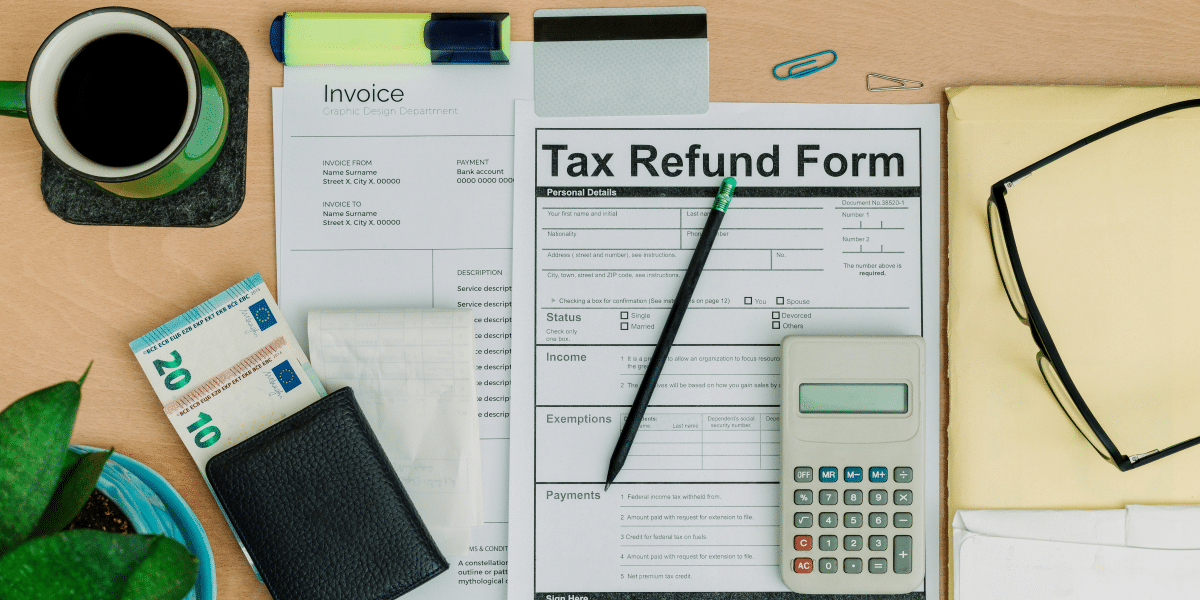

Financial calculations rely heavily on both accuracy and efficiency. You can’t ignore the importance of quickly processing your computations to focus entirely on the accuracy of your results.

No! This practice can’t work in financial systems because they generally have a heavy workload. So, people in such sectors often use different techniques to guarantee accuracy and efficiency in all sorts of calculations. One of the most unconventional yet effective strategies is rounding or rounding off—a mathematical technique for approximating a value. It involves simplifying numbers or values for shorter or clearer representation. But how can this pave the way for accuracy and efficiency?

This article will share the role of rounding off numbers for improved accuracy and efficiency in financial calculations. It will also discuss some experts’ wisdom on rounding off numbers to help you do it correctly.

How Can Rounding Pave the Way for Accuracy and Efficiency in Financial Calculation?

The mathematical technique of simplifying numbers to predefined criteria has many advantages. Two of them are accuracy and efficiency, especially in financial calculations.

Make Complicated Computations Easier

Complex and lengthy financial calculations are often tricky to understand and work with. So, if you are performing such computations, you can simplify them using the rounding technique. For example, calculating interest rates or loan payments often get complicated or lengthy. But you can make things easier by rounding certain numbers to a specific decimal place. Doing so will make the computation more manageable and understandable. Eventually, you will be able to complete the entire calculation quickly and accurately.

Reduce Financial Loads and Improve Resource Utilization

Financial systems, like banks, insurance companies, and stock exchanges, generally have a lot of calculation load, especially when handling extensive datasets. This situation often slows down the entire processing and resource usage. However, the strategy of rounding numbers can optimize such workflows. For instance, by rounding off lengthy numbers and values, banks, insurance companies, and stock exchanges can reduce the load. This way, the entire financial system will be able to process the values faster and utilize the resources more effectively than ever.

Decrease the Likelihood of Inconsistencies or Discrepancies

The traditional way of calculation frequently leads to discrepancies because it usually involves inconsistent rounding practices. However, you can avoid such a problem by following a more consistent or uniform approach. For instance, before starting financial computation, you can set a predefined round-off criterion for the values involved in the calculation. By following the same rounding standard throughout the computation, you will be able to maintain a coherent financial narrative and avoid any inconsistencies in the results.

Increase the Presentability and Understanding of the Values

People round off numbers primarily to make the whole computation easier to understand and communicate. So, rounding the values in financial reports and statements simplifies the presentation and understanding of the values. And when you follow this mathematical strategy, it helps you present your financial computations more clearly and professionally. Eventually, your stakeholders and decisions will find it more intuitive to make better judgments.

A Way to Round Off Figures in Financial Calculations

Now that the role of rounding in making financial calculations more accurate and efficient is clear to you, this section will discuss how to round off figures. That’s because it is impossible to benefit from the rounding technique without knowing how to implement it. So, generally, the following methods are the commonly used tactics to round off values in financial and mathematical computation:

- Ceiling or round-up

- Floor or round down.

- Round half up

- Round half down.

- Round half away from zero.

- Round half towards zero.

These methods are enough to handle various types of calculations. However, fully mastering the rounding technique requires carefully understanding each of the above-mentioned tactics. Alternatively, you can use https://roundingcalculator.info/ if you want an easier way to round off figures. Such a tool has already been programmed with all the industry-standard rounding-off methods. With its assistance, you just have to input the value that you want to round off and select a precision level. Upon processing, the rounding calculation utility will accurately formulate the results. So, if you’re looking to simplify rounding, you can get assistance from an automated utility.

Wrapping Up — Final Verdict

In a nutshell, rounding in financial calculations serves several important purposes. It simplifies complex calculations, reduces errors, enhances data organization, ensures consistency and standardization, and improves communication. By adopting the techniques to round off figures, you can overcome challenges in the accuracy and efficiency of calculations. Doing so will eventually lead to improved decision-making and better financial reporting. But you can only get these advantages if you have a firm command of rounding numbers. If you don’t, you can seek assistance from technology.

Published by: Khy Talara