Life insurance is one of the most important financial decisions, but figuring out how much coverage you need can be confusing.

Should you get just enough to cover final expenses, or should you plan for future financial support for your loved ones?

The answer depends on your circumstances, financial obligations, and long-term goals.

This guide will help simplify the process so you can determine the right amount of life insurance for your needs.

Why Having the Right Amount of Life Insurance Matters

Life insurance protects your loved ones, ensuring they are not left with unexpected expenses or financial difficulties. Having too little coverage may leave your family struggling to cover costs, while having too much could mean paying higher premiums than necessary. Finding the right balance ensures that your policy fits your budget while providing adequate support for your dependents.

Key Factors to Consider When Determining Life Insurance Coverage

Choosing the right amount of life insurance depends on several factors. Evaluating your financial situation and future responsibilities will help you make an informed decision.

Your Financial Obligations

One of the biggest reasons people buy life insurance is to cover financial obligations that may be left behind. Consider the following when calculating your coverage needs:

- Mortgage: If you have a home loan, life insurance can ensure that your family can continue living in the house without financial strain.

- Other Debts: Credit card balances, car loans, and personal loans should be accounted for so your family doesn’t inherit financial burdens.

- Living Expenses: Daily costs, including groceries, utilities, and transportation, should be covered to maintain your family’s standard of living.

- Childcare and Education: If you have children, factor in the cost of daycare, school fees, and future college tuition.

Your Income and Future Earning Potential

A key purpose of life insurance Ontario is to replace lost income, primarily if your family depends on your earnings. Many financial experts recommend getting coverage that is at least 5 to 10 times your annual salary to provide enough financial security for your loved ones.

Your Family’s Future Needs

Beyond covering immediate financial obligations, life insurance can also help secure your family’s future. Consider additional expenses such as:

- College tuition for children

- Medical or healthcare costs for dependents

- Support for a spouse or aging parents

Thinking ahead can help ensure your family has long-term financial stability, even in your absence.

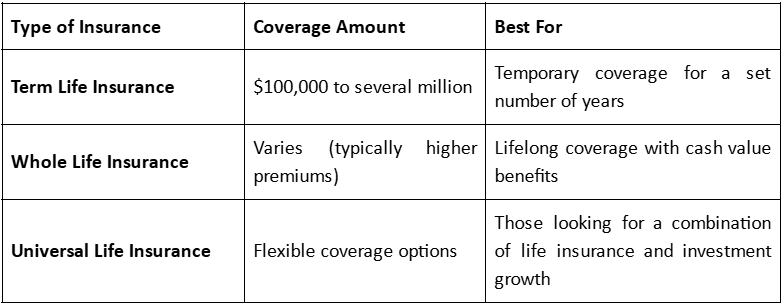

Types of Life Insurance and Their Coverage Options

Different types of life insurance provide different levels of coverage. Understanding the options available can help you choose a plan that best suits your needs.

Adjusting Coverage Based on Life Changes

Your life insurance needs are not static—they change as your financial situation evolves. It’s important to review your coverage after significant life events, such as:

- Marriage: You may need more coverage to protect your spouse.

- Having children: Future education and living expenses should be considered.

- Buying a home: Ensure your mortgage is covered so your family isn’t burdened with payments.

- Retirement: You may need less coverage if you have significant savings or no dependents.

Conclusion

Determining how much life insurance you need doesn’t have to be complicated. By considering your debts, income, mortgage, and future expenses, you can find a coverage amount that provides financial security for your loved ones. Whether you choose term, whole, or universal life insurance, selecting the right policy ensures your family is protected. Life is unpredictable, but with the right coverage, you can have peace of mind knowing that your financial responsibilities are taken care of.

Disclaimer: This article is for informational purposes only and does not constitute financial, insurance, or legal advice. Life insurance needs vary based on individual circumstances, and readers are encouraged to consult with a licensed insurance professional or financial advisor to determine the appropriate coverage for their specific situation.

Published by Stephanie M.