In the golden age of ecommerce, a seamless checkout experience isn’t just a luxury — it’s increasingly expected. Yet for many Shopify and direct-to-consumer (DTC) brands scaling beyond six or seven figures, the reality behind the scenes can be far from ideal. Payment processors may freeze, chargebacks can pile up, and legacy subscription tools sometimes lock businesses into systems that aren’t easily adaptable. While brands focus on ads and CRO hacks to grow revenue, their payment infrastructure often becomes an unforeseen bottleneck.

At the heart of the issue lies the fragmentation of the modern ecommerce tech stack. Brands often rely on multiple tools: Shopify for the storefront, Stripe or PayPal for payments, third-party plugins for subscriptions, a separate dashboard for fraud, and yet another tool for split testing checkout flows. While this modularity once offered flexibility, it now frequently leads to friction and, in some cases, lost revenue.

The Processor Freeze Problem

Imagine this: your brand is running a holiday campaign, ad performance is through the roof, and you’re watching sales roll in at record volume. Then, suddenly, payments stop processing. Your Stripe account is frozen pending a routine review triggered by a surge in volume. No warning. No recourse. Just an abrupt halt in your ability to collect cash.

This scenario is more common than many realize. Shopify and Stripe, while powerful and user-friendly, are optimized for scale within certain limits. Once your brand crosses certain thresholds — whether in revenue, refund rates, or dispute volume — you may trigger automated compliance systems. The freeze that follows can last days or weeks, potentially costing tens of thousands in lost revenue.

Chargebacks: The Silent Profit Killer

Even if your processor doesn’t freeze your account, chargebacks can quietly erode your margins. In the ecommerce world, even a 1% chargeback rate is often considered high risk. Once that threshold is breached, processors might impose rolling reserves (where they hold a percentage of your revenue), increase transaction fees, or, in extreme cases, shut you down entirely.

To make matters worse, chargeback mitigation tools are often either reactive or prohibitively expensive. Many DTC brands lack the operational bandwidth to build a robust chargeback response system internally, leaving them more exposed to risk.

The Subscription Trap

Then there’s the “token lock-in” dilemma. Many ecommerce brands rely on subscription billing to generate predictable revenue. But most subscription platforms encrypt payment tokens in a way that makes them non-transferable. That means if you ever want to migrate to a new provider — whether for better features, pricing, or reliability — you may not be able to do so without forcing customers to re-enter their payment information.

That friction alone can result in a 20-40% drop-off in active subscriptions. It’s a common challenge: you’re often stuck with your provider because moving typically means starting from scratch.

The Industry’s Hidden Cost

This fragmented backend infrastructure is not just inconvenient — it’s potentially costly. It can delay product launches. It might stall cash flow. It adds risk to every marketing push. Worst of all, it’s often preventable.

What most brands need isn’t another widget or plugin — it’s a more cohesive system. One that consolidates payments, subscriptions, fraud protection, and split testing into a single, more adaptable platform.

A New Era of Checkout Infrastructure

That’s where a platform like Lasso comes into play. Lasso is not just another checkout plugin — it’s a full-stack checkout infrastructure built with scalability in mind for ecommerce brands doing $1M+ in sales.

Instead of relying on a single processor, Lasso supports multi-processor routing, allowing brands to automatically fail over to backup payment providers if one fails or freezes. That means reducing the risk of missed revenue during processor outages.

It also offers native chargeback mitigation tools, built-in A/B testing for checkout flows, and portable subscription billing that helps avoid lock-in to a specific gateway. If you ever want to change providers, your tokens can move with you — a feature that’s rare in the space.

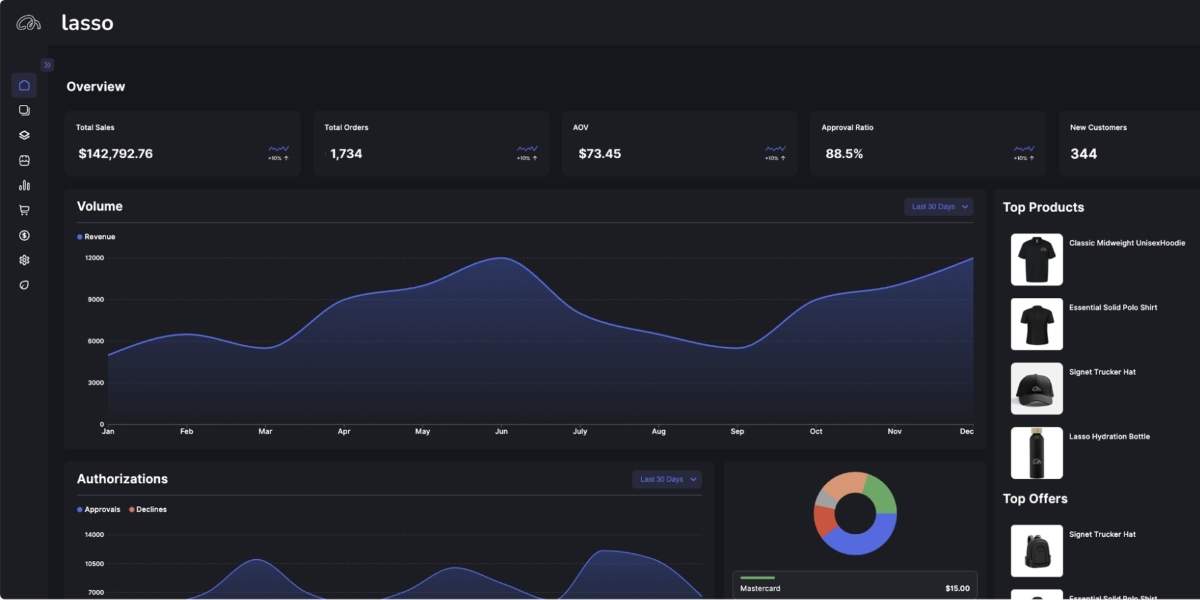

With a unified dashboard, operators get real-time visibility into approvals, declines, fraud threats, and conversion data — all in one place. The result? Potentially faster optimization, fewer surprises, and higher revenue retention.

The Bigger Picture

The story of ecommerce over the last decade has been one of explosive front-end innovation — beautiful stores, brilliant ads, and viral social content. But the backend? It’s often lagging behind. Most brands don’t think about payment infrastructure until something goes wrong.

Yet for brands looking to scale past $10M, $25M, or even $100M, the payment layer becomes increasingly critical. It’s not just about accepting credit cards—it’s about minimizing disruptions when momentum hits.

Solving this doesn’t require duct tape or more plugins. It requires a new approach entirely — one built around resilience, flexibility, and control. That’s what platforms like Lasso aim to deliver, and it’s why forward-thinking operators are making the shift now, before they hit their next growth ceiling.

In the end, the brands that win won’t just have the premier products or ads. They’ll have more resilient infrastructure, and they’ll be better equipped to handle processor freezes, chargeback spikes, or legacy subscription tool limitations without sacrificing growth.

Disclaimer: The information in this article is provided for general informational purposes and reflects features and benefits attributed to Lasso based on available sources. It does not constitute professional, financial, or legal advice. Individual results may vary depending on specific business circumstances and configurations. Readers should perform their own due diligence and consult with appropriate experts before implementing any payment infrastructure solutions.

Published by Jeremy S.