By: Nataliia Stashevska

New York: Capital of FinTech and Strict Regulations

New York has long been a global hub for financial technologies. Dozens of successful FinTech startups were born here — from Plaid and Betterment to Chime. According to Deloitte’s forecast, the U.S. FinTech market will grow to one trillion dollars by 2032, and a significant portion of new services is being launched right here.

But behind this growth stand more than just investment and technology. Every new product is immediately subject to strict requirements: the NYDFS Cybersecurity Regulation (23 NYCRR 500), federal GLBA, PCI DSS, and SEC regulations. These rules protect millions of users — but they also fundamentally reshape how digital financial products are designed.

Why a FinTech Analyst Is More Than a “Requirements Writer”

In many industries, an analyst is someone who asks the user, “What do you want?” and then documents the requirements. In New York FinTech, it’s different.

Here, a strong business analyst answers the key question: “Why does the user actually want this?” And more importantly — how to implement it in a way that’s legal, convenient, and secure.

“In New York FinTech, a business analyst isn’t just about diagrams and forms. It’s someone who sits between Legal, Security, and UX Designers — and translates their language for one another.” — Natalia Stashevska

Case Study: How One Right Question Saved Clients $1.2 Million

A New York FinTech startup working with freelancers launched an auto-payment bot. The idea seemed perfect — yet users were still receiving late fees.

Analysts conducted deep research using the Jobs To Be Done (JTBD) method. They discovered that freelancers’ income fluctuated weekly, while the bot deducted payments automatically — even when the account balance was zero.

The solution turned out to be simple: add a balance check and a pre-payment reminder a few days in advance. As a result, late fees dropped by 38%, and clients saved over $1.2 million in one year.

My Authorial Approach: Data-Driven JTBD Mapping

Traditional Jobs To Be Done (JTBD) analysis helps uncover why a user chooses a product. But in New York FinTech, that’s not enough.

My approach — Data-Driven JTBD Mapping — combines three sources:

- In-depth JTBD Interviews — What does the user actually want to “hire” the product to do?

- Product Analytics — Where are the real points of drop-off and behavior? (Clicks, funnels, heatmaps)

- Regulatory Constraint Map — Which UX features can and cannot be implemented due to NYDFS, PCI DSS, or other rules?

At the intersection of these three layers, the business analyst finds a solution that not only appeals to the customer — but also stays within legal boundaries.

Photo Courtesy: FinTech

What Colleagues Are Doing

I conducted a brief survey among 20 business analysts and product managers working in FinTech:

✅ Only 20% actually combine CJM, JTBD, and product analytics.

❌ About 60% rely solely on UX testing and A/B experiments, without digging into user motivation.

❌ Another 20% still use the classic approach — writing user stories without diagnosing underlying drivers.

Conclusion: Even in 2025, BA practice in New York FinTech often underutilizes hybrid methods. For an experienced analyst, this is a real opportunity to stand out.

5 JTBD Questions for FinTech

If you want to quickly validate a user scenario, start with these questions:

- When and where do you usually use this service?

- What exactly are you trying to do?

- Why is it important right now?

- What did you do before to solve this problem?

- What would have to happen for you to stop using this solution?

Mini Checklist: Drop-Off Points in the Customer Journey

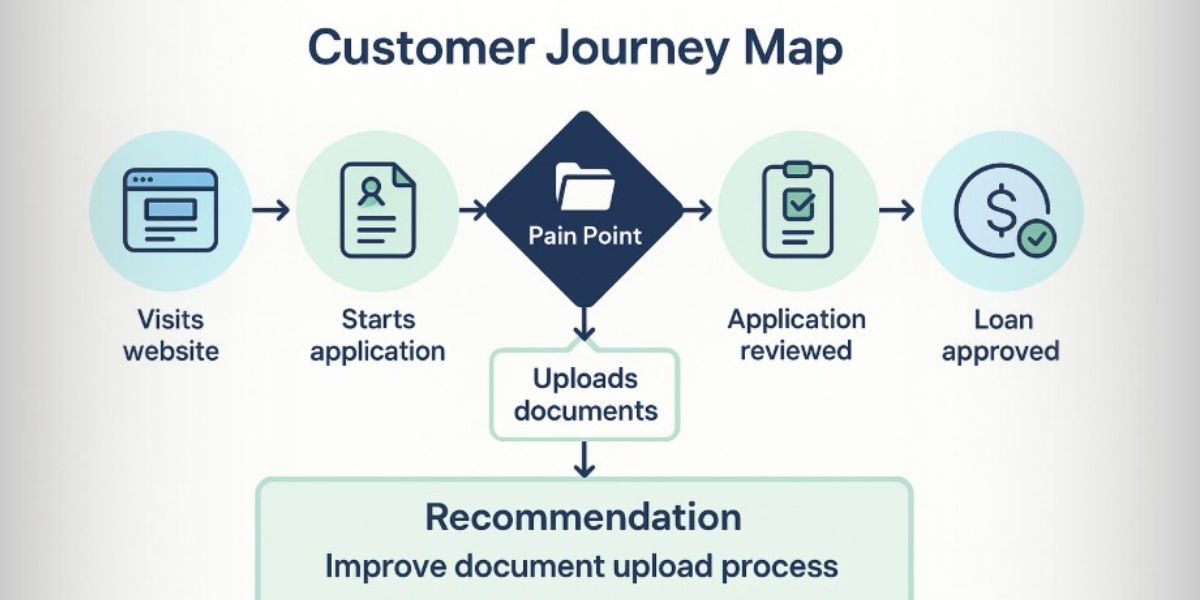

After conducting interviews and analyzing the CJM, check:

✔ Where does the customer postpone or abandon an action? ✔ Is there a “blind spot” — a step no one’s really thinking about? ✔ What might be blocked by NYDFS or PCI DSS compliance? ✔ Can this step be automated or simplified without violating regulations?

New York FinTech = Zone of Risk and Growth

NYDFS is one of the strictest financial regulators in the U.S. Even small gaps in data protection or access control architecture can result in multi-million dollar fines. That’s why solid business analysis isn’t a “nice-to-have” — it’s a key to survival and growth.

What To Do Tomorrow

- Review your customer journey map: where do users “go off track”?

- Conduct at least one JTBD interview: “What are you actually trying to accomplish with this?”

- Align your next feature with Legal and Security before you reach MVP or even run A/B tests.

Sources:

Deloitte Fintech Trends, 2024

NYDFS Cybersecurity Regulation: dfs.ny.gov

Notable New York FinTech companies: Plaid, Betterment, Chime

Disclaimer: The information provided is for general informational purposes only and is not intended as legal, financial, or professional advice. Readers are encouraged to consult with relevant professionals before making any decisions based on the content.