By: Crystal Morrison

No doubt many real estate investors have heard of the 1031 exchange derived from the 1921 approved Section 1031 of the Internal Revenue Code. After all, for more than 100 years, investors have been able to defer taxes on capital gains and depreciation recapture at the time a real property investment is sold if the net equity from the sale is reinvested into a similar property of the same or greater value within a specified time frame. This term “like-kind” real estate may be broadly defined to include most investment assets such as multifamily apartment communities, self-storage, multi-tenant retail buildings, and essential net lease distribution facilities.

Many real estate investors are familiar with 1031 exchanges but may not be as aware of Delaware Statutory Trusts as an option to consider.

A Historical Look at the Delaware Statutory Trust

- As early as the 16th century, property being held in trust by one person for the benefit of another was an integral part of the English Common Law. Lawyers have used the concept of the “common law” trust for centuries to help wealthy people pass ownership of assets from one generation to another with the least amount of taxation and a significant amount of security. However, common law trusts are often outdated and can create several legal disputes within the trust. So, in 1988, the State of Delaware wanted to create a new statutory trust entity designed to improve the functionality of trusts in structured financial transactions. While several states had adopted statutes recognizing trusts for business purposes, the Delaware Business Trust Act of 1988 was the first to completely rewrite outdated common law trust principles and introduce new provisions that greatly expanded how investors could use a trust entity in modern structured financial transactions. In 2002, the State of Delaware officially changed the name to the Delaware Statutory Trust Act, and two years later, the Internal Revenue Service’s Revenue Ruling 2004-86 was passed, allowing DSTs to be used as like-kind real estate for 1031 exchange replacement property purposes.

Delaware Statutory Trust properties have gained attention in 1031 exchanges, with billions of dollars in equity expected to be invested into DSTs in the coming year, reflecting steady growth from the previous year.

But just what is it about the DST investment structure that appeals to investors? For many professional and retail real estate investors, DSTs offer at least four appealing advantages for 1031 exchange investors, including the following.

Tax Advantages of the Delaware Statutory Trust

DSTs provide an option for investors looking to defer taxes that can arise when selling investment real estate that has appreciated over many years. This can be particularly appealing for those who have owned rental or commercial properties for a long time, want to sell, but face challenges finding a suitable property to exchange into or are concerned about the potential tax implications. Since DSTs qualify for 1031 exchanges, they can help defer taxes such as federal capital gains tax, state capital gains tax, depreciation recapture, and the Medicare surtax, which can collectively represent a significant portion of the sale proceeds.

DST 1031 Properties Passive Real Estate Investments

One of the most attractive aspects of DST 1031 exchange investments to many investors is that they eliminate the challenges associated with active ownership and management. This may appeal to investors near or at retirement who are tired of the hassles that real estate ownership and active management often bring. They are tired of tenants, toilets, and trash and want to avoid actively managing their real estate.

In DST investments, a DST sponsor creates the DST and is responsible for managing the entire business and assets of the trust. These responsibilities can include the following:

- Underwriting the real estate

- Conducting all the research and review on the property(s)

- Arranging the necessary financing – although some DST 1031 investments are debt-free with no loans on them

- Creating a business plan for the property(s)

- Finding a property management team.

- Coordinating investor relations and potential monthly distribution checks to investors.

In this way, the Delaware Statutory Trust syndication provides investors with a passive ownership structure, allowing them to enjoy retirement, grandkids, travel and leisure.

According to Dwight Kay, Founder and CEO of Kay Properties, investors in DSTs also receive the potential for monthly distributions.

“Investors can potentially receive monthly income and 100% of the pro-rata portion of any potential principal pay-down from the loan on the property, thereby potentially building equity. In addition, DST 1031 properties are structured so that the investors in the DST receive 100% of their pro-rata portion of the potential net rental income generated by the property’s tenants,” said Kay.

Access to Larger, Institutional Grade Assets

Delaware Statutory Trust properties for 1031 exchanges allow investors to access larger, high-quality real estate assets that might otherwise be out of reach. With relatively low minimum investment requirements, investors can purchase fractional ownership in properties such as industrial distribution centers, multifamily apartment complexes, or multi-tenant retail spaces. This structure allows investors to participate in real estate opportunities that may not have been accessible individually.

The Potential to Reduce Risk Through Greater Diversification

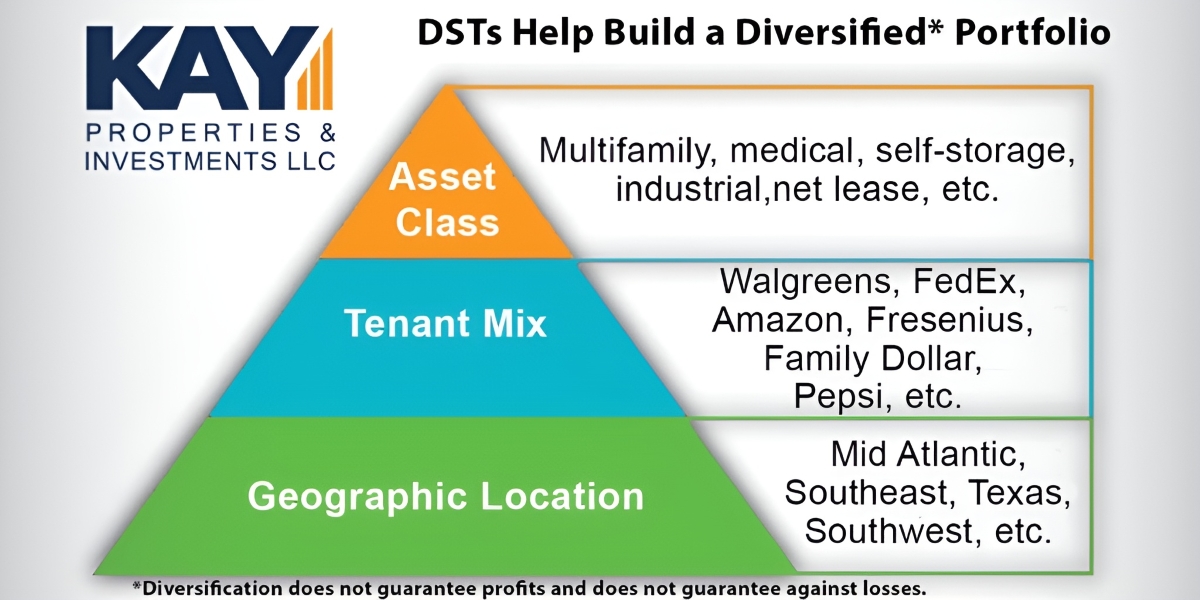

Another advantage of the Delaware Statutory Trust structure for 1031 exchange investors is that it increases the ability of investors to invest in multiple properties, thus potentially reducing individual risk. Beyond allowing investors to participate in various investment properties, DST syndications also enable investors to invest in multiple asset classes (multi-family, commercial buildings, self-storage, medical facilities, industrial distribution centers, etc.) and numerous geographic locations.

Portfolio optimization and diversification was first recognized by Nobel-Prize winning economist Harry Markowitz and continues to be one of the most proven economic theories for success today, including its application in Delaware Statutory Trust 1031 exchanges. * It is important to note, however, that diversification does not guarantee profits or protection against losses. Investors should read each DST offering’s Private Placement Memorandum (PPM), paying attention to the risk factors before considering a DST investment.

Obviously, as with all forms of real estate investments, investors should be aware of an underlying level of risk, including things like economic downturns, vacancies, tenant bankruptcies, etc. Investors should not invest in DST investments or real estate syndications if they cannot sustain the loss of their invested principal.

About Kay Properties and www.kpi1031.com:

Kay Properties helps investors choose 1031 exchange investments that help them focus on what they truly love in life, whether their children, grandkids, travel, hobbies, or other endeavours (NO MORE 3 T’s – Tenants, Toilets and Trash!). We have helped 1031 exchange investors for nearly two decades exchange into over 9,100 – 1031 exchange investments. Please visit www.kpi1031.com to access our team’s experience educational library and complete the 1031 exchange investment menu.

Disclaimer: This material is not tax or legal advice. Please consult your CPA/attorney for guidance. Past performance does not guarantee or indicate the likelihood of future results. Diversification does not guarantee returns and does not protect against loss. Potential cash flow, potential returns and potential appreciation are not guaranteed. There is a risk of loss of the entire investment principal. Please read the Private Placement Memorandum (PPM) for the offering business plan and risk factors before investing—securities offered through FNEX Capital LLC member FINRA, SIPC.

Published by Mark V.