Foreclosure is a legal process in which lenders attempt to recover the balance of a loan from a borrower who has stopped making payments. Understanding the foreclosure process in New York is essential for homeowners and investors, as it helps them navigate the complex legal landscape and make informed decisions.

Overview of Foreclosure in New York

In New York, foreclosures are primarily judicial and processed through the court system. This process typically takes about 445 days, making New York the state with the extended foreclosure timeline in the U.S.

Pre-Foreclosure Period

Before initiating legal action, the lender must send a Notice of Default at least 90 days before filing for foreclosure. This notice must be sent via registered or certified mail and first-class mail to the borrower’s last known address and the property address. The notice must include an updated list of at least five housing counseling agencies serving the property’s county.

Judicial Foreclosure Process

Filing of the Complaint

The foreclosure process begins with the lender filing a complaint and serving the borrower with a summons. The borrower has a specified period to respond and contest the foreclosure in court.

Court Proceedings

If the borrower contests, the case goes to trial. If the court rules in favor of the lender, a final judgment of foreclosure is issued. The judgment mandates that the property be sold to satisfy the mortgage debt.

Notice of Sale

After the court’s judgment, a Notice of Sale is issued and must be published in a local newspaper once a week for at least four weeks before the sale. The sale is conducted at a public auction, usually at the county courthouse.

Foreclosure Auction

The property is sold to the highest bidder at a public auction. The winning bidder must pay in cash or certified funds, and the ownership is transferred upon payment.

Borrower Rights and Protections

Borrowers in New York have specific rights and protections, including:

- The right to be notified of foreclosure proceedings.

- The opportunity to appear in court and contest the foreclosure.

Redemption and Deficiency Judgments

Redemption

New York does not allow borrowers the right of redemption after a foreclosure sale, meaning they cannot reclaim their property once it has been sold.

Deficiency Judgments

Lenders may seek a deficiency judgment within one year after the sale if the sale price does not cover the mortgage balance. This requires the lender to make a motion within 90 days post-sale to confirm the foreclosure sale and pursue the remaining balance.

Alternatives to Foreclosure

Borrowers facing foreclosure can consider several alternatives:

- Loan Modification: Adjusting the terms of the loan to make payments more manageable.

- Short Sale: Selling the property for less than the loan balance with the lender’s approval.

- Deed in Lieu of Foreclosure: Voluntarily transferring the property to the lender to avoid foreclosure.

- Selling Mortgage Notes: Provides a lump sum of cash and helps avoid the negative impact of foreclosure.

Comparative Insights

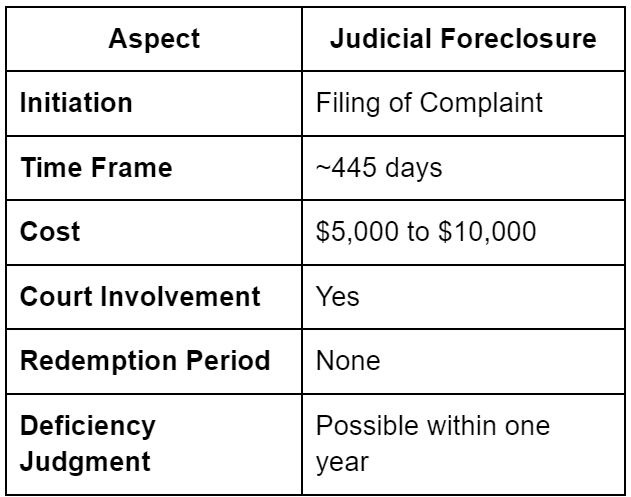

New York’s judicial foreclosure process is lengthy and expensive compared to non-judicial processes in other states. The table below provides a comparative overview of key aspects of New York’s judicial foreclosure process:

Conclusion

Understanding the foreclosure process in New York, including the timelines and legal requirements, is crucial for navigating this challenging situation. Homeowners should be aware of their rights and explore all available options to avoid foreclosure when possible. Staying informed and proactive can help mitigate the impact of foreclosure and lead to better financial outcomes.

Disclaimer: “This content is for informational purposes only and is not intended as financial advice, nor does it replace professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.”

Published by: Khy Talara