By: Quist Bazaar

Qist Bazaar, Pakistan’s leading “buy now, pay later” (BNPL) platform serving underserved populations, has secured 3.2 million dollars in Series A funding. Beyond a significant financial boost, this marks an equity partnership between international venture capitalists and a leading BNPL commercial bank, a historic moment for economic inclusion for the people of Pakistan.

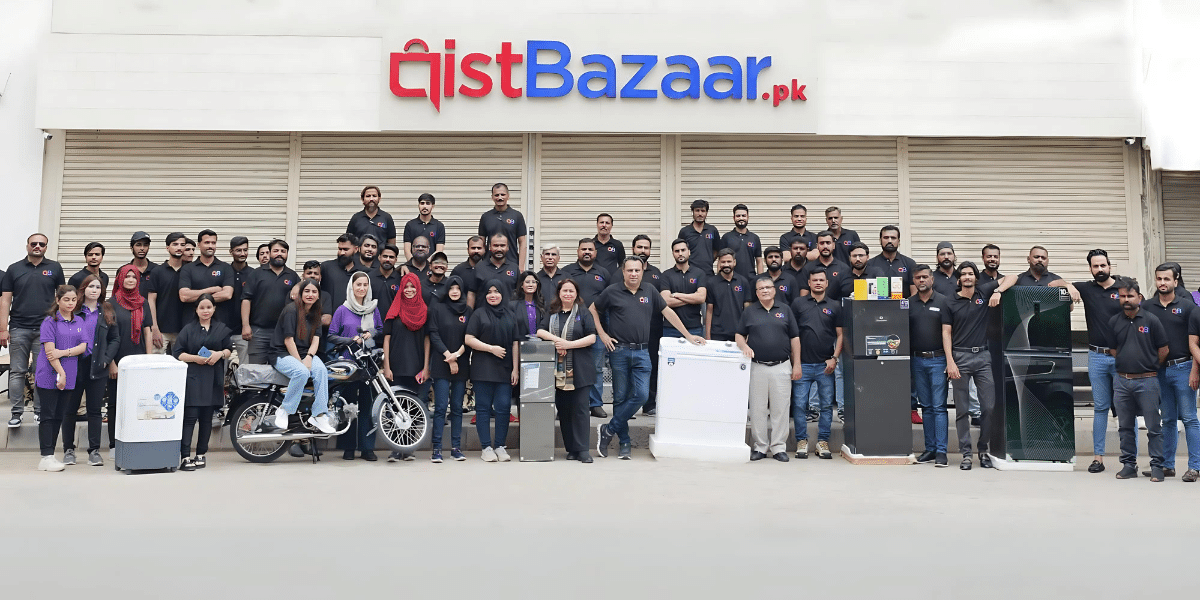

With the motivating tagline, “Every Pakistani,” Qist Bazaar’s approach strives to reshape financial inclusion in Pakistan, ensuring essential goods are given to the population who have historically been excluded. However, considering around 100 million adults in the country are presently without a bank, there are challenges due to unjust structural systems and systemic barriers.

Qist Bazaar’s approach is innovative, single-handedly restructuring the system, allowing underserved populations to access necessary items through flexible, installment-based payment plans. Not only does it help with access to products, but it builds credit and secures a place in the banking system. From rickshaw drivers to domestic workers, no one needs to go without. Their timing simply couldn’t be better as the country’s economy reaches a critical juncture of inflation rising and the cost of living soaring sees more and more Pakistani people struggling to afford necessities.

Historically, traditional banks are reluctant to provide credit to these marginalized groups, simply labeling them as “high-risk” due to a lack of financial history. Through a hybrid credit-scoring model that evaluates both traditional and alternative factors, Qist Bazaar is effectively democratizing credit access while establishing financial inclusion for millions.

The significant investment comes from diverse and powerful investors, including Indus Valley Capital, Bank Alfalah, and Gobi Partners — which speaks volumes to the potential. Indus Valley Capital has backed several industry-leading startups in the country, and invested in Qist Bazaar not only for its financial returns but for its inspirational impact. Aatif Awan, Founder and Managing Partner, shared, “What excites us here is not just the market opportunity but the impact that Qist Bazaar can have on the everyday lives of millions of Pakistanis.”

As one of Pakistan’s largest commercial banks, Bank Alfalah’s involvement is equally noteworthy. The bank’s strategic backing comes with impressive institutional credibility and unprecedented access to debt financing. In a market where liquidity constraints often hinder growth, this partnership will support Qist Bazaar in scaling its services quickly, allowing even more folks access to affordable financing solutions.

Qist Bazaar attracted these leading investors in part due to its strikingly impressive financial discipline. Where other global BNPL platforms often struggle to achieve profitability, Qist Baazara has been EBITDA-positive from the very start. This showcases the company’s dedication and passion for sustainable growth—a typically elusive quality in the startup space normally dominated by skyrocketing valuations but plagued by unsustainable business models. Their profitability permits the platform to reinvest in its mission, pushing toward long-term stability while serving an ever-growing base of customers. With a low delinquency rate and strong unit economics, Qist Bazaar is not just surviving in the competitive landscape—it’s thriving.

The future is looking just as promising. The platform has announced exciting growth plans and launched new products, including solar power generators for small households. Qist Bazaar is positioning itself as more than a fintech player—it’s becoming a bedrock of Pakistan’s consumer economy. The company has even entered into B2B2C partnerships with major textile companies, indicating its goal of weaving installment-based payment solutions into Pakistani commerce.

Qist Bazaar is a shining example in the startup space, demonstrating that it’s possible to prioritize people over profit, aligning social good and impact with business success. The investment secured is groundbreaking, and the platform is leading in financial and social inclusion and innovation. With strategic backing from industry leaders and a clear focus on sustainable growth, Qist Bazaar is poised to revolutionize how consumer financing is done in the country, inviting millions of people in and driving the nation towards a more sustainable, equitable future.

Published by: Nelly Chavez