By: Frank Hubert

Fintech represents a remarkable intersection of fundamental financial management principles and advanced technology. It has revolutionized traditional approaches to banking, investment, and insurance. Innovations like blockchain, cloud computing, and AI have automated complex processes, minimized risks, and created highly customer-centric products.

But fintech is more than just tools that simplify transactions. It’s an entire philosophy built on transparency, trust, and enhanced security. People today demand instant, personalized access to their finances. For traditional financial institutions, fintech is a true catalyst for transformation. By fostering inclusivity, it doesn’t just improve global economic processes – it redefines what it means to manage money.

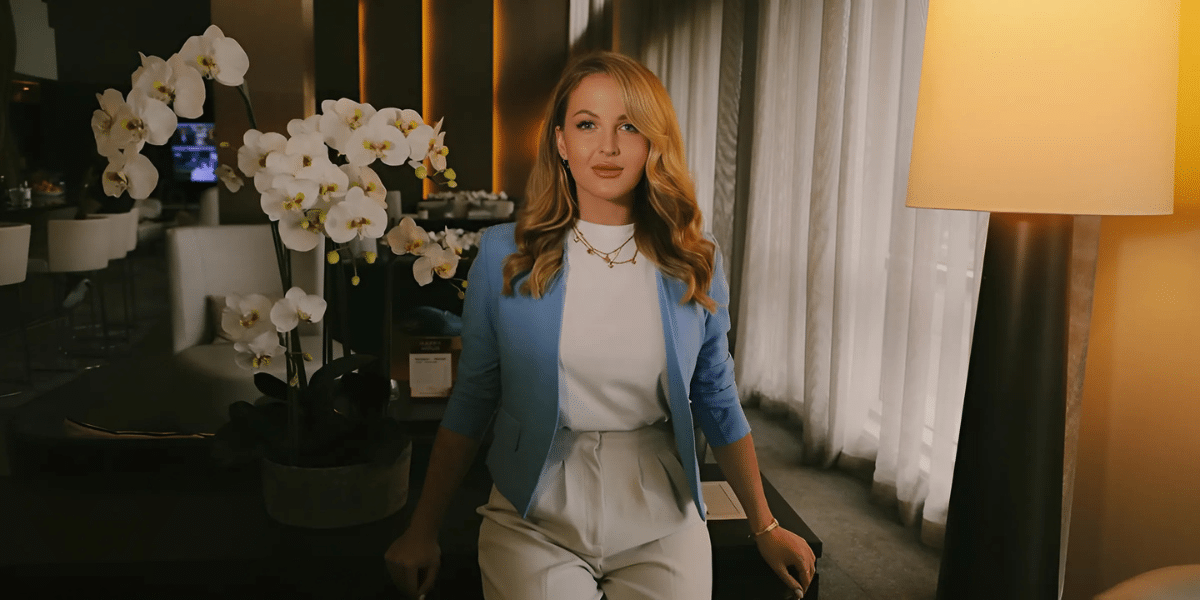

Our guest today is Maya Novikova, Vice President at JPMorgan Chase & Co. A native of Ukraine, Maya is a highly skilled professional with a proven track record in driving operational excellence in the SaaS sector of the financial industry. She is also a Magna Cum Laude graduate in international business etiquette and protocol and a recipient of Ukraine’s national “Great Ukrainians” award for her innovative cross-functional team management methodology.

Maya chose a career path in program management and has quickly achieved remarkable success in managing digital products. We spoke with her about what makes the role of a Digital Products Vice President in fintech unique and the skills required to excel in this demanding field.

Maya, let’s start with the fundamentals. How does the role of a Digital Products Vice President in fintech differ from similar roles in other industries?

– Fintech is one of the most dynamic and highly regulated industries. The key difference lies in how a Digital Products VP operates at the intersection of stringent legal requirements, intense competition, and rapidly evolving customer expectations.

For example, in e-commerce, you can test a feature, gather feedback, and make adjustments quickly. In fintech, you can’t just release a product to the market and see how it performs. Everything must be meticulously planned, carefully designed, and rigorously tested, taking into account legal, financial, and technical aspects.

Additionally, Fintech products often involve people’s money, which makes them highly sensitive. As a result, a Digital Products VP’s responsibility goes beyond ensuring functionality; it also involves building trust. The challenge is to deliver not only a seamless user experience but also an absolutely reliable product.

You mentioned legal aspects. How do they influence business process management?

– Fintech requires exceptional attention to detail and thorough planning. Digital Products management in this field must be both agile and structured. For instance, developing a new feature for a payment service involves close collaboration with legal teams, banking partners, and regulators. A Digital Products VP must synchronize all stakeholders without losing focus on the ultimate goal: creating value for the customer.

Another critical aspect is risk management. Risks in fintech can be financial, legal, or reputational. A Digital Products VP must know how to mitigate these risks at every stage, whether they pertain to system architecture or marketing campaigns.

How do you maintain team productivity under such high-pressure conditions without causing conflict or stress?

– Mistakes in Fintech can be costly, which naturally heightens stress levels within teams. It’s crucial to foster an environment where people feel supported and trusted. I always emphasize that mistakes are a part of the process. What’s important is to address them quickly, learn from them, and move forward. This approach reduces fear and encourages initiative within the team.

Equally important is balancing flexibility with strict deadlines. Deadlines in fintech are often dictated by external factors, so a Digital Products VP must not only be an expert in their products but also a strong communicator capable of resolving conflicts and keeping the team motivated.

In your professional opinion, what qualities are most essential for a Digital Products Vice President in fintech?

– First and foremost, system thinking. It’s crucial to view products as an interconnected whole, understanding every detail and its impact on the business and individual clients. Second, emotional intelligence. You need to be able to understand people’s feelings and motivations, build rapport with colleagues and clients, and navigate complex interpersonal dynamics. Finally, adaptability. Change is a constant in fintech, so you must be ready to pivot and meet new requirements head-on.

What advice would you give to aspiring Digital Products managers in fintech?

– Don’t shy away from challenges, and commit to continuous learning and self-improvement. Fintech is inherently innovative, so staying ahead requires not only technological expertise but also a solid understanding of regulatory frameworks, business models, and even psychology. Most importantly, love what you do. Passion for your work is the best source of motivation, discipline, and inspiration!

Published by Elle G.