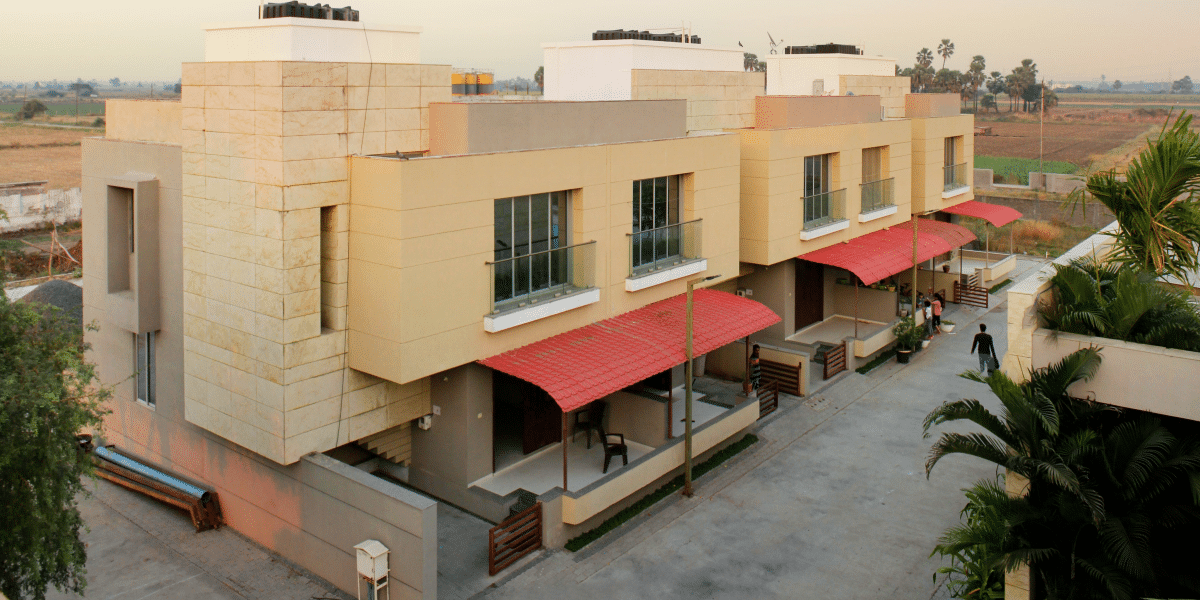

By: inspirabuilders

Buying property in India as a Non-Resident Indian (NRI) can be a rewarding investment, allowing individuals to stay connected to their roots and secure assets for the future. However, the process has its own set of guidelines and requirements specific to NRIs. From legal formalities to tax implications, here’s a guide to help NRIs navigate the journey of buying property in India.

Understanding Eligibility

The good news is that under the Foreign Exchange Management Act (FEMA), NRIs can buy property in India, including residential and commercial properties. However, agricultural land, farmhouse properties, and plantation properties cannot be purchased by NRIs unless they inherit them.

1. Choose the Right Type of Property

NRIs can freely buy residential and commercial properties, but there are restrictions on agricultural land and plantations unless they inherit it. This choice can affect your property management and rental options, especially if you plan to lease the property out overseas.

2. Ensure All Legal and Financial Documents Are in Place

Before investing, NRIs should ensure they have the following:

- PAN Card: Required for transactions and tax purposes in India.

- Proof of Identity and Address: Passport, OCI or PIO card, and current address proof.

- Bank Account in India: For easy financial transactions, an NRE (Non-Resident External) or NRO (Non-Resident Ordinary) account is needed.

- Power of Attorney (POA): If you cannot be present in person to sign documents, a POA-authorized individual can sign on your behalf.

3. Understand Financing Options for NRIs

NRIs can access home loans from Indian banks, provided they meet the eligibility requirements. Here’s what to keep in mind:

- Indian banks offer home loans to NRIs at competitive interest rates.

- A 20% to 30% down payment is typically required, and banks may finance up to 80% of the value of the luxury apartments in Banashankari.

- Loan repayment must be made from an NRE or NRO account in Indian Rupees.

4. Research Legal Compliance and Property Verification

Property verification is critical to avoid legal disputes. NRIs should verify:

- Title of Property: Ensure clear ownership by checking property title deeds.

- Encumbrance Certificate: Verifies that the property is free of legal dues.

- RERA Registration: The Real Estate Regulatory Authority ensures that projects are transparent and comply with laws.

- Tax Dues: Make sure that property taxes are paid, and no dues are pending.

5. Tax Implications and Financial Planning

Property purchases in India come with tax implications for NRIs, such as:

- TDS (Tax Deducted at Source): TDS on property purchases is 1% if the property is under ₹50 lakh and 20% for higher amounts.

- Capital Gains Tax: Property sales are subject to short-term or long-term capital gains tax.

- Rental Income Tax: Income earned from renting the property in India is taxable under Indian laws.

Also Read: India’s Real Estate Landscape: Overcoming Challenges and Seizing Opportunities

6. Plan for Property Management

Many NRIs prefer hiring property management companies to take care of maintenance and tenant management. A property management service can handle renting, regular maintenance, payment collection, and inspections, making it easier for NRIs to manage their assets while living abroad.

7. Understand Currency Repatriation Rules

NRIs may want to repatriate the proceeds from property sales or rental income. According to FEMA guidelines, an NRI can repatriate up to $1 million per financial year if they have completed tax compliance. Repatriation of capital gains must follow RBI guidelines and can be made through NRE or NRO accounts.

Final Thoughts

Buying property in India as an NRI can be a rewarding venture with long-term financial and sentimental value. Ensuring compliance with legal guidelines and planning finances carefully can help NRIs make the most of their investment. Consulting real estate advisors, tax experts, and legal consultants can further smooth the process, ensuring your property investment is secure and profitable.

With these steps, NRIs can confidently navigate their way through property purchases in India, making the experience as smooth as possible. Whether you’re looking to secure an asset, generate rental income, or build a future home, understanding the regulations and planning can help you make a wise investment.

Disclaimer: This article is intended for informational purposes only and does not constitute legal, financial, or investment advice. Non-Resident Indians (NRIs) are encouraged to consult with qualified professionals, including legal advisors, financial consultants, and tax experts, to ensure compliance with applicable laws and regulations when purchasing property in India. While efforts have been made to provide accurate and up-to-date information, the author and publisher are not liable for any errors, omissions, or outcomes resulting from reliance on this content. Always verify current rules and practices before making any property-related decisions.

Published by Zane L.