Germany’s automotive sector has long been a cornerstone of the nation’s economy, symbolizing engineering excellence and innovation on a global scale. However, the industry is facing unprecedented challenges, with the biggest German car manufacturer at the forefront of this crisis. Struggling with high costs and decreasing profitability, their current predicament serves as a critical case study for the future of the entire German automotive market.

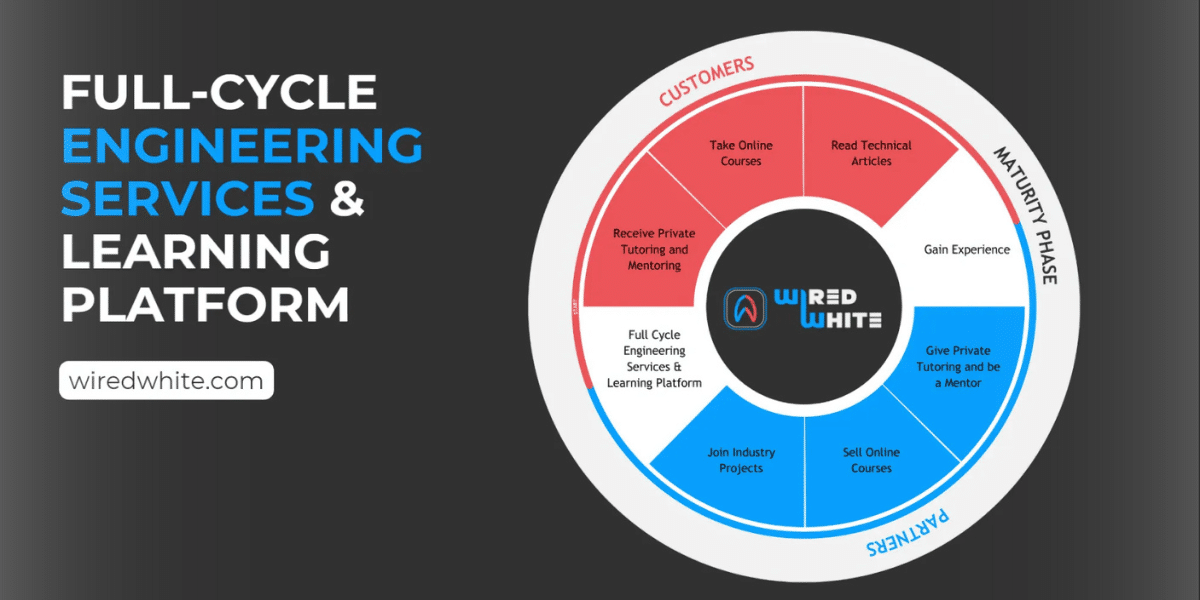

WiredWhite, a German Full-Cycle Engineering Service Provider with many years of experience in the automotive industry and core know-how in Electric Drives, evaluates the situation as follows.

German Automotive Market’s Current Crisis

The biggest German automaker is grappling with a confluence of crises, while reporting in 2023, a revenue increase by about 15%, its net profits dropped by 15% compared to the previous year. In a situation of declining profitability, the company is forced nevertheless to heavily invest in electrification, software development, and autonomous driving technologies to remain competitive.

In addition to that, due to shrinking profits and high operating costs, a hiring freeze of new employees has been introduced and even the closure of plants combined with layoffs are in discussions.

Because of high operational costs the German company is unlikely to be able to offer electric vehicles at the same attractive conditions to consumers as competitors do. The current market price for a common electric vehicle of the biggest German car brand starts at €34,000, whereas a comparable electric vehicle from the Chinese biggest EV manufacturer already imported and sold on the German market costs €28,000, a price difference of more than 20%.

Attracting New Cashflow Through the Split into Separate Entities

One strategy that could help navigate the crisis would be to break up the corporation into smaller, more agile companies, much like Siemens with its Healthcare and Energy Divisions. In 2017 the market cap of Siemens AG was €95 billion [1]. Right after Siemens spun off its healthcare and energy divisions, the sum of the market cap of all three independently operating companies increased to €215 billion in 2021, which is a growth of 126% [1]- [3]. General Electric (GE) also split its industrial, healthcare, and energy businesses into separate entities in recent years, boosting the individual companies’ valuation potential.

By splitting the biggest German car manufacturer’s numerous brands into independent publicly traded companies (AGs), each could focus on its core competencies and growth strategies and thereby individually attracting shareholders without being affected by the parent company’s crisis.

Acquisition by a Chinese Company

Another option is an acquisition by a Chinese automaker. The Chinese automotive industry has rapidly evolved, with several companies becoming global players. A notable example is when a Chinese company acquired a well-known Swedish brand in 2010, allowing the Swedish company to benefit from substantial financial support and access to the booming Chinese market. Since the acquisition, the Swedish brand’s revenues have nearly tripled, reaching around $30 billion in 2022, with profit margins increasing from approx. 4% to 7%. The brand has returned as an attractive car choice on the European streets, without losing in reputation.

Moving to Cheaper Locations

Another possibility is shifting more of the company’s production capacity outside of Germany to more affordable markets. Currently, the major German car manufacturer has substantial production in countries like Slovakia, Poland, and Hungary, where labor costs are significantly lower than in Germany. According to Eurostat, the average hourly labor cost in Germany’s manufacturing sector was around €41-42 in 2022, compared to approximately €14 in Poland and €10-11 in Slovakia.

Relocating more production facilities to Eastern Europe or even Asia could help the automaker reduce costs, particularly as it shifts towards EVs, which require a fundamentally different production setup than traditional internal combustion engine vehicles.

Introduction of New Working Models

WiredWhite Co-Founder, Dr. Dimitri Weiss, explains that the decrease of operating costs is possible with the introduction of a new working model. To increase employee efficiency and satisfaction and make use of electrification know-how without boundaries, the traditional office job arrangement must be replaced by remote world-wide collaboration and exchange of knowledge. Dr. Weiss describes: “WiredWhite has introduced a platform-based virtual coworking space, where we unite Engineering and IT experts from all over the world. In addition to that, we provide all crucial instruments for smooth virtual cooperation ranging from online meetings rooms to a project management system. This allows us to support the Product Development of our customers in an agile and effective way.”

Conclusion: A Change is Unavoidable

The automotive industry became more dynamic than ever, and German automotive companies seem to have missed the boat, currently loosing competitive strength to the growing American and Chinese competition. Being a German company, WiredWhite is keen to see the German automotive corporations flourish again and will support them with all expertise necessary, no matter which future path they will choose.

Market capitalization of Siemens, https://companiesmarketcap.com/eur/siemens/marketcap/

Market capitalization of Siemens Healthineers, https://companiesmarketcap.com/eur/siemens-healthineers/marketcap/

Market capitalization of Siemens Energy, https://companiesmarketcap.com/eur/siemens-energy/marketcap/

Published by: Josh Tatunay