One woman and her company are stepping up to ensure that the next generation is well-equipped to handle their finances. Meet Ebony Beckford and her innovative venture, Fin Lit Kids—a multimedia edutainment company committed to making financial literacy accessible and enjoyable for children aged 3-7. Through fun and engaging games, activities, books, and digital content, they are changing the way kids learn about money.

Company Spotlight: The Visionary Behind Fin Lit Kids

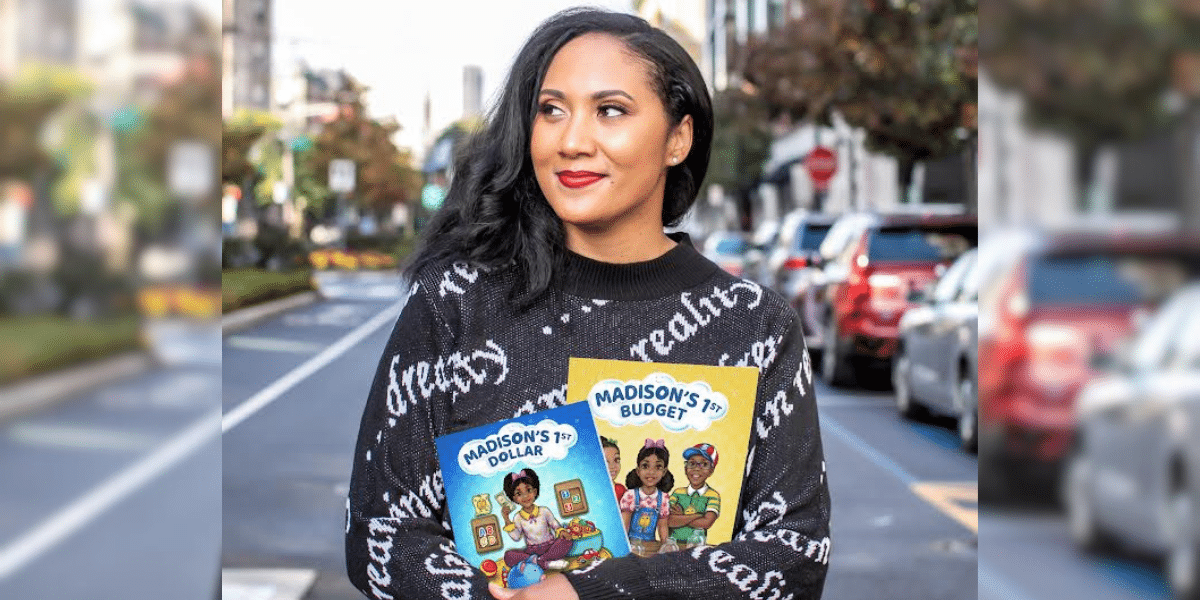

Ebony Beckford is the founder of Fin Lit Kids, a company that helps adults teach young children about money. She is also an author, entrepreneur, and financial literacy advocate who wants to close the wealth gap in America. Her passion for early financial education began in 2020 when she wrote and published her best-selling children’s book, “Madison’s 1st Dollar.” This book inspired her to create Fin Lit Kids, a company that offers books, games, and resources to teach basic money concepts to kids.

Ebony has a Communication Arts degree from St. John’s University and a successful career as a real estate tech executive for nine years. She has also received recognition and support for her work, such as a $10,000 grant from UPS Ignite and Accion Opportunity Fund in 2022.

Unveiling the Unseen Aspects of Fin Lit Kids

What sets Fin Lit Kids apart is their unwavering commitment to excellence, rooted in research and collaboration with educational experts and psychologists. Beyond the surface, their materials are not just fun but also cognitively enriching. This meticulous approach ensures that children gain a profound understanding of money management that will serve them well into adulthood.

Unique Characteristics of Fin Lit Kids

Fin Lit Kids is a company that aims to teach children about money in a fun and engaging way. They use familiar tools of early childhood education, such as nursery rhymes, and give them a financial literacy twist. For example, they are currently working on an album that features money-themed versions of popular nursery rhymes. This unique approach helps children learn important money management concepts effortlessly, by combining what they already know with new financial insights.

Empowering Parents and Educators with Fin Lit Kids

Fin Lit Kids is a company that helps parents and educators teach children healthy financial habits from an early age. They understand that personal finance can be intimidating and complicated, so they create children’s products that make the teaching process simple and fun. Fin Lit Kids makes it easy for adults to include financial education in their children’s daily routines, using familiar and engaging tools such as books, games, and songs.

“Restoring Generational Wealth”: Fin Lit Kids’ Motto for Change

Ebony Beckford’s tagline, “Restoring Generational Wealth,” captures the essence of Fin Lit Kids’ mission. Rather than just building wealth, the focus is on recognizing and honoring the rich legacy of affluence within communities of color. By understanding and embracing this heritage, they aim to reshape perspectives and drive positive change.

Diverse Narratives in Financial Education: The Commitment of Fin Lit Kids

Fin Lit Kids is a company that values representation and diversity in their educational content. They create stories that feature characters who are often underrepresented in conversations about money management. This inclusivity ensures that all children can relate to the stories and learn from the experiences of the characters. FinLit Kids’ goal is to foster a world where every child can connect with diverse characters, who inspire them to achieve their financial dreams and goals. By doing so, Fin Lit Kids hopes to enrich the learning experiences of children and prepare them for a global society.

The Power of Early Financial Education

The strategic focus of Fin Lit Kids’ on children aged 3-7 is grounded in solid developmental principles, recognizing the crucial role these formative years play in shaping a child’s foundational beliefs, especially regarding money. This deliberate choice goes beyond conventional teaching methods and reflects a deep commitment to sculpting a path toward a more financially secure future. At ages 3 to 7, young minds are exceptionally receptive to learning, making it an ideal time to instill fundamental financial literacy principles. These early lessons form an integral part of a child’s cognitive framework, fostering fiscal responsibility and a well-informed approach to finances as they grow. In essence, Fin Lit Kids doesn’t merely teach; they empower children to make informed financial decisions, ensuring they are well-prepared for the complexities of the financial world ahead.

The Personal Drive Igniting Fin Lit Kids’ Mission

The inspiration behind the inception of Fin Lit Kids is deeply rooted in Ebony’s personal journey. Her mother’s untimely passing when she was just eighteen exposed her to the harsh realities of financial hardship and underscored a glaring gap in financial education. Fueled by her own experiences and a fervent desire to spare future generations from similar struggles, Ebony embarked on a dedicated mission to make financial literacy accessible to young minds.

The Future of Fin Lit Kids

Looking ahead, Ebony envisions Fin Lit Kids as the go-to resource for early financial education. In five years, they aim to expand their product range, which currently includes interactive apps, physical products, and school curricula. Their goal is to establish global partnerships to reach children worldwide.

Empowering Readers

The objective here is to equip readers with a profound understanding of the significance of early financial education. The unwavering commitment of Fin Lit Kids and Ebony Beckford to narrowing the wealth divide and instilling financial literacy in children serves as a powerful testament to the transformative potential of education. By instilling essential money management skills in children from a young age, we can guide them toward financial independence and prosperity, thereby enriching not only their individual lives but also the broader communities in which they thrive.