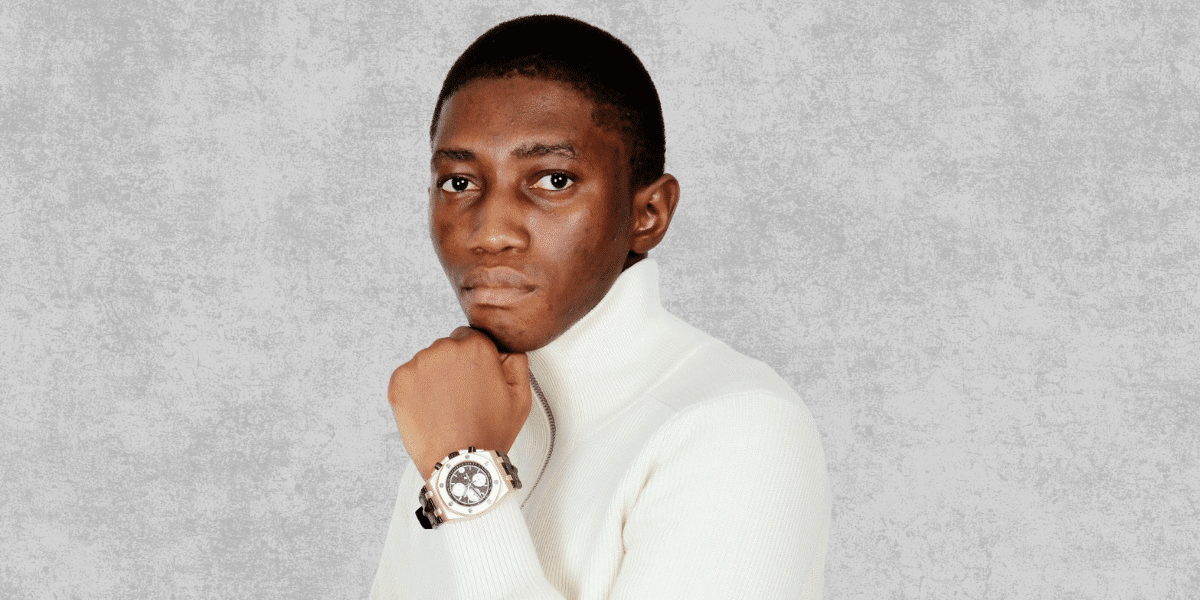

Renowned finance author David Olarinoye challenges the traditional interpretation of the 2008 financial crisis, suggesting it should be perceived not as a catastrophe but as a pivotal event that reshaped fortunes. According to his insights shared on RichCulture.co, while many suffered financial losses during that period, savvy investors capitalized on the market turmoil to generate life-altering wealth.

David O asserts that financial downturns like the one in 2008 are predictable and present unique opportunities for those prepared. By reframing the narrative surrounding past crises, he advocates for a proactive approach to navigating future economic uncertainties. Instead of viewing downturns solely as risks, he urges investors to recognize them as moments ripe for strategic investment and wealth accumulation.

As the world grapples with ongoing economic challenges and the specter of future downturns looms large, David O’s message serves as a beacon of hope and empowerment. By embracing a mindset of preparedness and seizing opportunities in times of crisis, individuals can safeguard their financial well-being and position themselves to thrive in adversity.

In an era characterized by volatility and uncertainty, David O’s perspective offers a refreshing take on navigating finance. By recognizing the potential for wealth creation amid crisis, investors can approach the future with confidence and resilience, ensuring they are not merely bystanders to economic upheaval but active participants in shaping their financial destinies.

Furthermore, David O emphasizes the importance of understanding historical patterns and market cycles. By studying past crises and their aftermaths, investors can gain valuable insights into how to navigate present and future challenges. This analytical approach allows them to identify emerging opportunities and make informed decisions, mitigating risks and maximizing returns.

Moreover, he underscores the significance of diversification in investment strategies. By spreading investments across different asset classes and sectors, investors can reduce their exposure to specific risks and enhance their overall portfolio resilience. This diversified approach helps them weather market fluctuations and capitalize on opportunities across various market conditions.

Additionally, David O advocates for continuous learning and adaptation in the face of changing economic landscapes. By staying informed about market trends, technological advancements, and global developments, investors can stay ahead of the curve and position themselves for long-term success. This proactive stance enables them to adjust their strategies accordingly and seize emerging opportunities, ensuring sustained growth and prosperity.

In conclusion, David Olarinoye’s perspective on the 2008 financial crisis not only challenges the conventional understanding of economic downturns but also provides insightful guidance on how to navigate through uncertain economic times. His approach encourages a paradigm shift, viewing economic crises not just as challenges but as vital opportunities for growth and innovation. By advocating for proactive investment strategies, such as diversifying portfolios and seeking out undervalued assets during downturns, Olarinoye suggests that individuals can not only protect but also enhance their financial health. Furthermore, his philosophy emphasizes the importance of resilience and adaptability, proposing that these qualities enable individuals to thrive in any market condition. This forward-thinking approach offers a comprehensive roadmap for those looking to turn economic uncertainty into a catalyst for securing and increasing personal wealth.

Published by: Nelly Chavez