By: James Brown

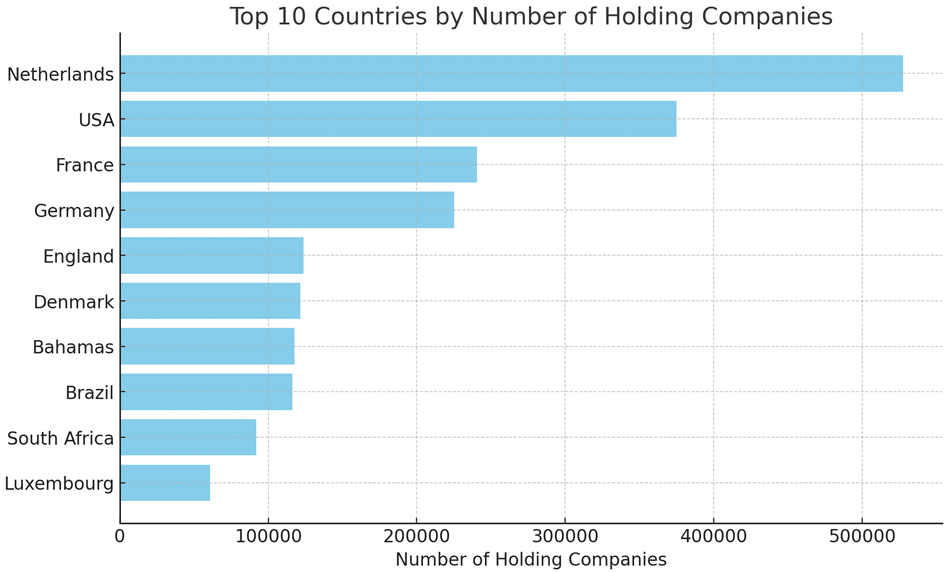

Amsterdam, Netherlands, is recognized as a global hub for holding companies. Recent data suggests that the Netherlands hosts a large number of holding companies, potentially exceeding half a million. France and the USA also have significant populations of holding companies. The Netherlands is situated centrally and has tax policies that some consider favorable.

Global Businesses Look for Dutch Tax Advantages

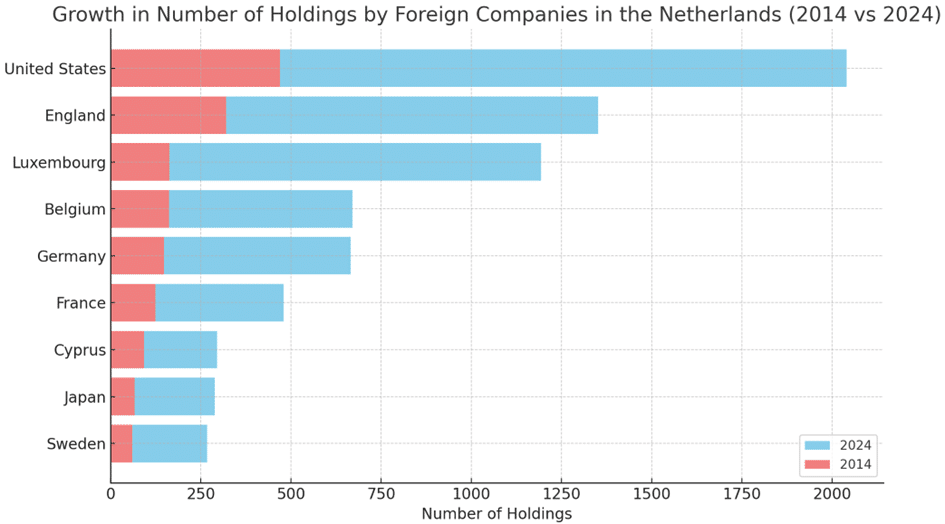

The Netherlands serves as a jurisdiction that attracts a diverse array of international companies, including both larger enterprises and smaller businesses. A significant number of U.S. companies have chosen to establish their presence in the Netherlands, taking advantage of its strategic location and favorable business environment. Additionally, Cyprus has experienced a noticeable increase in foreign holdings within the Netherlands over the past several years, contributing to its characterization as one of the relatively smaller economies in the region.

Photo Courtesy: BoldData

UK-owned Holdings Surge in The Netherlands

In recent years, a number of UK businesses have chosen to establish their operations in the Netherlands, potentially aiming to alleviate tax burdens and sustain operational stability amid increasing tax pressures in their home country. Data from BoldData suggests that the presence of UK-owned holding companies in the Netherlands has seen notable growth over the past decade. Specifically, these holdings appear to have risen from several hundred around 2014 to a considerably larger figure by 2024.

This trend may be influenced by the evolving tax environment in the UK, which some companies perceive as becoming less favorable. In addition to tax considerations, the Netherlands offers various strategic advantages that make it an attractive destination for international businesses. These include its central location within Europe, robust infrastructure, and a business-friendly regulatory framework, which can contribute to operational efficiency and access to broader markets.

Furthermore, the Netherlands is known for its supportive ecosystem for businesses, including access to skilled labor and a strong emphasis on innovation and sustainability. These factors, combined with favorable tax policies, may encourage companies of different sizes to consider the Netherlands as a viable option for their international operations. As a result, the Netherlands continues to be a preferred jurisdiction for businesses looking to optimize their operational and financial strategies in a dynamic global economy.

The UK Is Facing Increasing Tax Pressures

Rachel Reeves’ recent budget proposal includes a tax package to adjust employers’ contributions to national insurance. These changes are anticipated to take effect in April and may increase the percentage of contributions required from employers. In light of these adjustments, some UK companies might explore investment opportunities in countries that may offer more favorable tax environments, such as the Netherlands. This potential shift reflects businesses’ ongoing efforts to adapt to evolving tax policies and seek environments that support their operational and financial strategies.

Experts’ Opinions on Trend

The United Kingdom has voiced apprehensions about the possible effects stemming from new tax policy adjustments. Elliot Keck, serving as the head of campaigns for the TaxPayers’ Alliance, conveyed that there is a general concern among taxpayers regarding the sustainability of businesses within the country. Specifically, Keck mentioned that the proposed rise in employer national insurance contributions by the chancellor might lead some businesses and individuals who generate significant wealth to explore opportunities in nations that offer lower tax rates. He suggested that Rachel Reeves, presumably holding a governmental or influential position, should prioritize initiatives that aid and support businesses instead of implementing policies that might be viewed as critical or burdensome to the business community.

About BoldData

Data experts, we offer a large database covering millions of companies around the world. Our data has been used by many companies for CRM, analytics, and research purposes.

Published by Zane L.